How to fill PAN correction form online?

What is a PAN card?

Table of Contents

PAN or Permanent account number is a ten character alphanumeric identifier issued to every tax payer in India by the Income tax department. It is one of the most important identities issued to a person in India. No two tax paying individuals or entities can have the same PAN number. Most of the financial transactions in India will require quoting a PAN number which includes filing of an income tax return.

The PAN card is issued in laminated form and contains many details of an individual such as name, age or PAN number etc. PAN card is a valid identity as well proof of age as per KYC guidelines issued by government of India agencies like RBI. PAN card full form permanent account number.

Why do you need to apply for PAN correction?

PAN correction is needed in a variety of scenarios and one should not take it lightly. PAN number is required in almost all of the financial transactions in India including filing of income tax returns, opening a bank account, applying for a loan etc.

You need to apply for a PAN correction form in cases such as mistakes in name, date of birth, name of father, address etc. You should remember that PAN is an identity number and any wrong information can lead to a misplaced or a wrong identity.

If you notice any of these information wrongly mentioned in your PAN card then you should urgently apply for correction in PAN. You can apply for a PAN correction in multiple ways including offline and online mode. If you are filling PAN correction form in offline mode then you need to complete it fully and send it over to concerned authorities

However, if you are filling PAN correction form in online mode then you should be careful in completing application form as any wrong information would again lead to a wrong information in a PAN card. In this article, we would look into detail in how you can apply for PAN card correction through NSDL.

PAN card correction online on NSDL

Let us look into detailed step by step procedure for filing PAN correction form on NSDL portal-

Step 1 – Visit official NSDL portal

Step 2 – Under Services tab, click on PAN

Step 3 – Go down to change/correction in PAN data and click on apply button

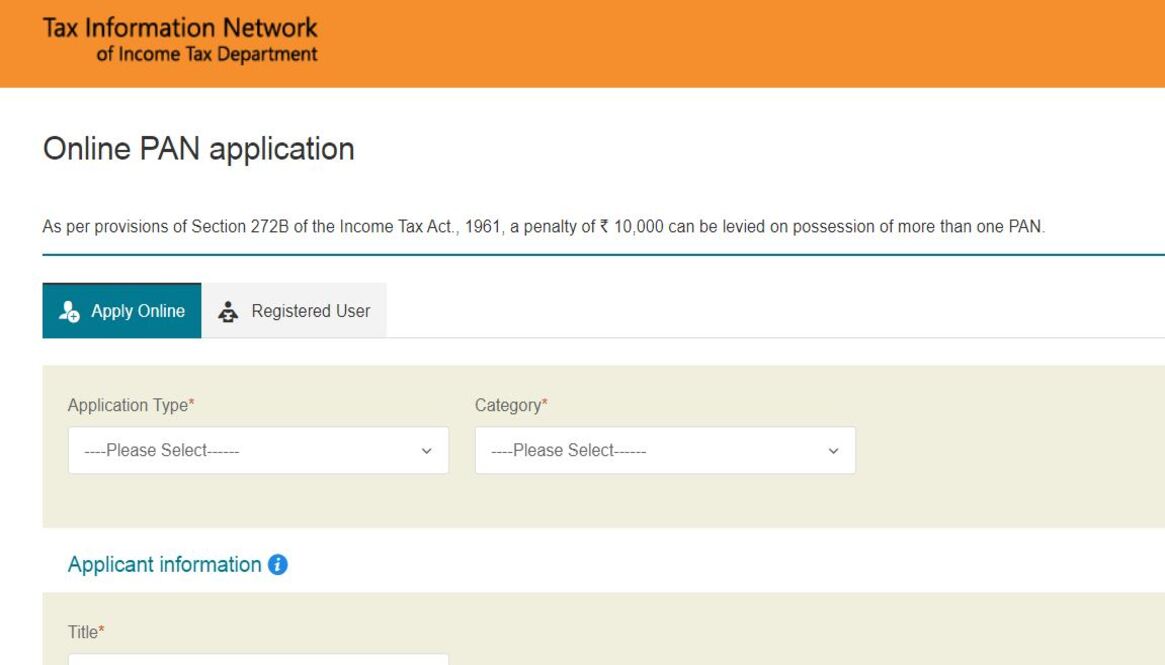

Step 4 – You would now get access to the PAN application form and under application type choose “changes or correction in existing PAN data/Reprint of PAN data” and choose your category under the same tab. If you are individual then kindly choose “individual” in category

Step 4 – Now, you would need to fill applicant information in PAN correction form. You would be required to fill in your details like title, name, surname, date of birth, email id, mobile number etc. These details are required to be compulsorily filed in PAN card correction form

Step 5 – Fill in Captcha details and click on submit

Step 6 – Post submission of a PAN correction form a token would be generated and will be sent to your email id. You need to click on “continue with PAN application form”

Step 7 – Now, you need to click on click on “Submit scanned images through e-Sign on NSDL e-gov”

Step 8 – Now, PAN correction form would require you to fill necessary details such as your father’s name, mother’s name (optional), your Aadhaar number and click on ‘Next’

Step 9 – You would be directed to a new page where you would need to update your address.

Step 10 – Upload necessary documents such as proof of address, proof of age, proof of identity and PAN

Step 11 – Now, sign the declaration and click “Submit”. You will be directed to a payment page post submission of PAN card correction form and you can pay through DD, Credit card, net banking etc.

Step 12 – Post successful payment, an acknowledgement slip would be generated. You need to send an acknowledgement slip along with documents to the following address.

NSDL e-Gov at Income Tax PAN Services Unit,

NSDL e-Governance Infrastructure Limited,

5th Floor, Mantri Sterling, Plot No. 341,

Survey No. 997/8, Model Colony,

Near Deep Bungalow Chowk, Pune – 411 016

Fees for correction in PAN card through PAN correction form

PAN card correction fees are the same as fees for fresh PAN card applications. These fees are –

- Rs 101, if address is within India

- Rs 1011, if address is outside India

FAQs on PAN correction form online

Q – Can I make a request for a PAN card correction form online?

A – Yes, you can make a request for PAN correction online in either UTI or NSDL.

Q – Which fields can I correct in PAN?

A – You can correct following information in PAN such as name, father’s name, date of birth, photograph, address etc.

Q – Who can make a request for a PAN card correction?

A – An applicant who possesses all mandatory documents such proof of identity, proof of address and proof of date birth can apply for a PAN correction

Q – What are the fees for applying for a PAN correction form?

A – Fees for PAN correction are 101 if your communication address is within India and if your communication address is outside India then fee would be Rs 1011

Q – Can I change my photograph in a PAN card?

A – Yes, you can change your photograph in PAN card

Q – Can I change my signature on my PAN card?

A – Yes, you can change your signature in PAN card

Q – How long does it take to get a PAN card corrected from Income Tax authorities?

A – You can get a PAN card corrected within 15 days from application date for correction

Conclusion

In this post, we have discussed in detail about step by step procedure in filing PAN correction form online. One needs to apply for a PAN correction in multiple scenarios including wrong name, wrong date of birth, incorrect father’s name in PAN. signature mismatch with PAN and other identity documents etc.

You can apply for a PAN correction form on NSDL by following simple steps such as filing of general information such as name, contact information etc. Post completion and payment for correction form, you need to send acknowledgement receipt along with mandatory documents to NSDL office.

If you interested in reading our other posts on PAN card related topics, you can find it here-

- Important points related to PAN application form

- Documents required for a PAN card application form

- How you can link PAN with aadhar

- Guided tour of TIN NSDl Portal

- How to check PAN card status on NSDL

- How to check UTI PAN status