Axis Bank Loan

Axis Bank Loan

Table of Contents

Axis Bank is one of the largest private sector banks in India. Axis Bank has branches located pan India and it is one of the few banks who is aggressive on digital transformation for its banking products. Axis Bank offers variety of loan products for personal as well as for business use. In this article, we would look into various loan products offered by Axis Bank to its customers across India.

Axis Bank personal loan offerings

Axis Bank is a major financial institution that offers variety of loan offerings for personal use. Following are the major loans that are offered by Axis Bank in personal domain-

- 24*7 Loan

- Home Loan

- Personal Loan

- Holiday Loan

- Car Loan

- Business Loan

- Education Loan

- Two Wheeler Loan

- Loan against property

- Gold Loan

- Loan against securities

- Loan against Fixed deposits

- Commercial Vehicle and construction vehicle Loan

We would look into each and every loan product that is offered by Axis Bank in its retail portfolio in detail and would cover topics such as Loan eligibility, Loan interest rates, Loan EMI, Loan documents etc. Let us dive into it one by one-

Axis Bank 24*7 Loan

Axis Bank offers 24*7 loan for applicants and it is a complete digital, instant and simple process to avail different types of loan. Key features of a Axis Bank 24*7 Loan are-

- Multiple options to login your application

- Complete flexibility to chose your loan amount and tenure

- Income assessment on real time

- eNACH authentication and complete digital video KYC process

Following loans can be availed under Axis 24*7 Loan-

- 24*7 Personal Loan

- 24*7 Car Loan

- 24*7 two wheeler Loan

- 24*7 Business Loan

Axis Bank Home Loan

Axis bank offers its home loan products across all income and loan amount level. Axis bank offers Home loan product to individuals from 10 Lakhs to 15 Crores. Axis Bank also offers various home loan offerings under various government schemes such as Pradhan mantri Awas Yojana and others. Axis Bank Home Loans offers customized tenures, rate of interest and loan amount depending upon eligibility of the customer. Let us look at various Axis Home Loan product in detail.

Axis Bank Home Loan classic

Axis Bank offers a classic home loan product that starts from Rs 3 lakhs to its customers and non customers. Key features of a Axis home Loan classic product are-

- Attractive interest rates

- No prepayment charges

- Both Fixed and floating interest rates

Axis Home Loan Eligibility

This loan is offered to salaried individuals working in reputed companies and government organizations. Age of applicant should be between 21 years and 60 years at the time of loan opening and closure respectively. Professionals such as doctors, engineers, dentists, architects, chartered accountants, cost accountants, company secretary, and management consultants are also eligible for this loan. Moreover, maximum age is relaxed to 65 years for self employed professionals.

For Axis Bank Home Loan, you would need to provide margin to the lender. margin required is calculated as follows-

- For Home Loan less than 30 Lakhs, margin required would be 10%

- For Home Loans between 30 lakhs and 75 Lakhs, margin required is 20%

- For Home Loan greater than 75 Lakhs, margin required is 25%

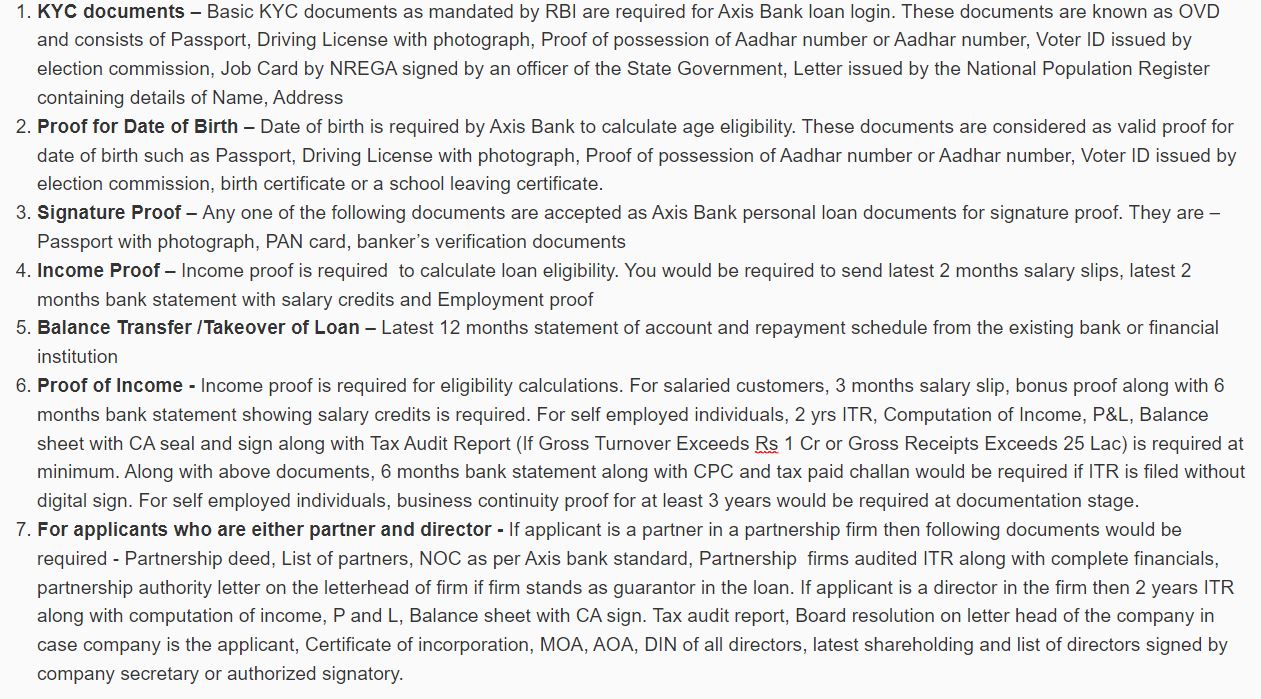

Axis Home Loan Documents

- KYC documents – Basic KYC documents as mandated by RBI are required for Axis Bank loan login. These documents are known as OVD and consists of Passport, Driving License with photograph, Proof of possession of Aadhar number or Aadhar number, Voter ID issued by election commission, Job Card by NREGA signed by an officer of the State Government, Letter issued by the National Population Register containing details of Name, Address

- Proof for Date of Birth – Date of birth is required by Axis Bank to calculate age eligibility. These documents are considered as valid proof for date of birth such as Passport, Driving License with photograph, Proof of possession of Aadhar number or Aadhar number, Voter ID issued by election commission, birth certificate or a school leaving certificate.

- Signature Proof – Any one of the following documents are accepted as Axis Bank personal loan documents for signature proof. They are – Passport with photograph, PAN card, banker’s verification documents

- Income Proof – Income proof is required to calculate loan eligibility. You would be required to send latest 2 months salary slips, latest 2 months bank statement with salary credits and Employment proof

- Balance Transfer /Takeover of Loan – Latest 12 months statement of account and repayment schedule from the existing bank or financial institution

- Proof of Income – Income proof is required for eligibility calculations. For salaried customers, 3 months salary slip, bonus proof along with 6 months bank statement showing salary credits is required. For self employed individuals, 2 yrs ITR, Computation of Income, P&L, Balance sheet with CA seal and sign along with Tax Audit Report (If Gross Turnover Exceeds Rs 1 Cr or Gross Receipts Exceeds 25 Lac) is required at minimum. Along with above documents, 6 months bank statement along with CPC and tax paid challan would be required if ITR is filed without digital sign. For self employed individuals, business continuity proof for at least 3 years would be required at documentation stage.

- For applicants who are either partner and director – If applicant is a partner in a partnership firm then following documents would be required – Partnership deed, List of partners, NOC as per Axis bank standard, Partnership firms audited ITR along with complete financials, partnership authority letter on the letterhead of firm if firm stands as guarantor in the loan. If applicant is a director in the firm then 2 years ITR along with computation of income, P and L, Balance sheet with CA sign. Tax audit report, Board resolution on letter head of the company in case company is the applicant, Certificate of incorporation, MOA, AOA, DIN of all directors, latest shareholding and list of directors signed by company secretary or authorized signatory.

Other important documents to be submitted along with above documents are-

- Completely filled application form

- Processing Fee and CERSAI cheques

Axis Home Loan documents before disbursement

- Loan agreement and annexures

- NACH mandate and SPDC

- Loan cover and insurance details

- Processing Fee cheques

- Property documents

- Own contribution receipts

- Sanction letter

- TDS

- PSL documents

Axis Bank Home Loan interest rates

Axis Bank charges both fixed as well as floating interest rates on its home loan. Axis Bank home loan interest rates for salaried and self employed are mentioned below-

For Salaried-

| Type | Repo Rate + Spread | Effective Rate of Interest |

| Floating Rate | Repo Rate + 2.75% to Repo Rate + 3.10% | 6.75% – 7.10% p.a. |

| Fixed Rate | All Loan Amounts | 12% |

For Self Employed-

| Type | Repo Rate + Spread | Effective Rate of Interest |

| Floating Rate | Repo Rate + 2.90% to Repo Rate + 3.20% | 6.90% – 7.20% p.a. |

| Fixed Rate | All Loan Amounts | 12% |

Axis Bank QuickPay Home Loan

Axis Bank offers a quick pay home loan for its customers. Quick pay Home loan from Axis Bank offers a unique benefit of quickly repaying your home loan by paying higher principal amount initially due to which interest burden reduces later on. Interest rates, documents required and loan tenure are same for Axis Bank classic home loan product. maximum tenure offered for home loan is 30 years.

Axis Bank Shubh Arambh Home Loan

Axis Shubh Arambh Home loan is a basic home loan offered to new customers with minimal documentations and faster disbursal. With Shubh Arambh loan, you can take advantage of the interest subsidy offered under Pradhan Mantri Awas Yojana Scheme. These Home Loans are offered for a minimum amount of 1 lakhs to 30 lakhs with a tenure up to 30 years.

Axis Fast Forward Loan

Axis fast forward loan is an easy to apply loan from Axis Bank. One can get the EMI waiver up to 12 months post good repayment track record for the same. Loan amount offered in this loan is in between 30 lakhs to 5 crores. maximum loan tenure offered in this loan is up to 30 years

Axis Asha Home Loan

Asha home Loan offers a loan amount up to Rs 35 lakhs for its customers. Moreover, you would get EMI waiver also with good repayment track record. Asha Loans offers loan amount up to 90% value of the property.

Top up Home Loans

Top up Home loan is a loan offered on a existing home loan. Maximum Loan amount offerd under top up home loans is up to 50 Lakhs

Super Saver Home Loan

Super saver home loan provides you with additional facility of super saver account in which you can park your additional amount from time to time basis. Any amount that you would deposit in the super save account would result in reduced principal on your loan account. Super saver home loan interest rates are same to other Axis Home loans. Moreover, you would also be earning interest on any additional money parked in the account. You would not be required to pay any pre payment charges for the early prepayment of your loan amount.

Power Advantage Home Loan

These loans come with a facility of fixed rate of interest for initial 2 years. Post that, interest rate would change to floating rate of interest

Power Advantage Home Loan Eligibility

This loan is offered to salaried individuals working in reputed companies and government organizations. Age of applicant should be between 21 years and 60 years at the time of loan opening and closure respectively. Professionals such as doctors, engineers, dentists, architects, chartered accountants, cost accountants, company secretary, and management consultants are also eligible for this loan. Moreover, maximum age is relaxed to 65 years for self employed professionals.

For Axis Bank Home Loan, you would need to provide margin to the lender. margin required is calculated as follows-

- For Home Loan less than 30 Lakhs, margin required would be 10%

- For Home Loans between 30 lakhs and 75 Lakhs, margin required is 20%

- For Home Loan greater than 75 Lakhs, margin required is 25%

Power Advantage Home Loan Interest rates

Home Loan interest rate at Axis Bank is calculated on the basis of markup over a MCLR rate. MCLR rates are fixed by central government. However, Home Loan interest rates for salaried customers are 20-30 BPS lower compared to self employed person.

Power Advantage Home Loan Documents

For complete list of documents required for a Home Loan, you can refer picture below-

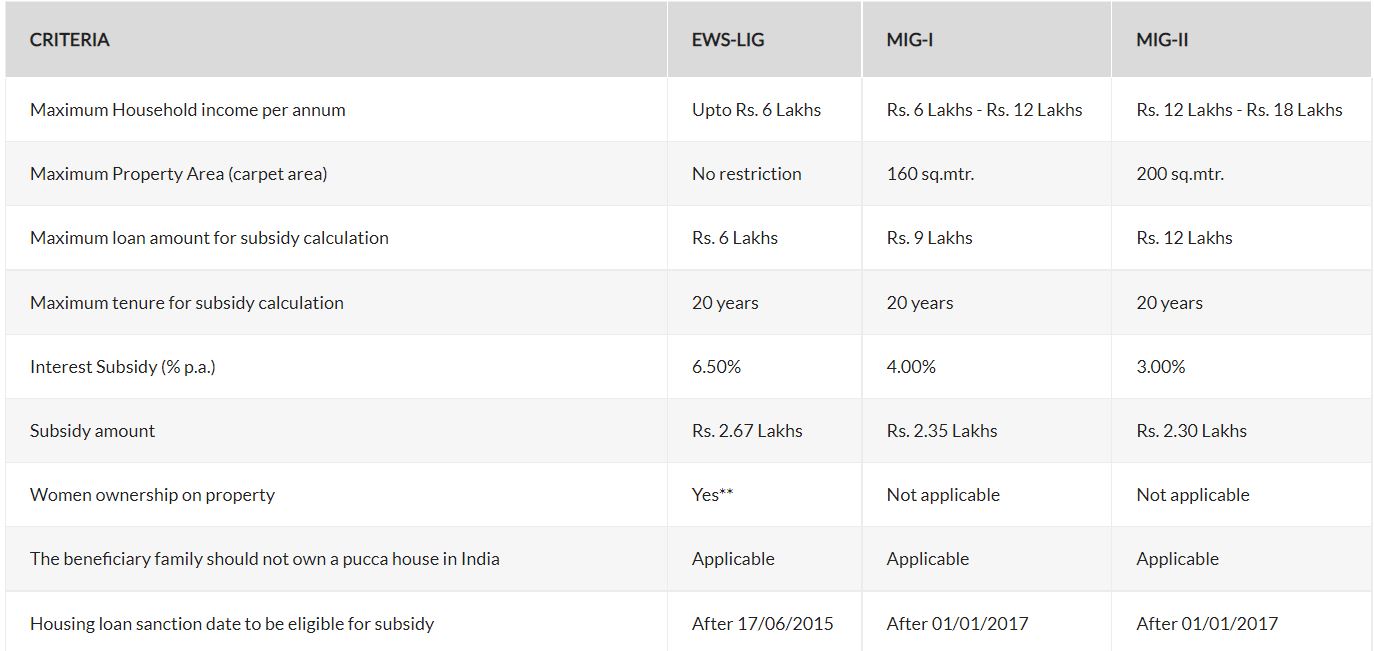

Pradhan Mantri Awas Yojna

This scheme provides interest subsidy for housing loans taken by LIG, MIG and EWS segment. This benefit can be availed on construction of property as well as buying of a new property. PMAY scheme eligible family list can be obtained from below table-

Axis Bank Holiday Loan

Axis Bank offers holiday loan to potential customers at cheaper rate of interest compared to other banks. Axis Bank offers Holiday loan from 50,000 to 15,00,000 for a loan tenure from 12 months to 60 months. Loan interest rates start at 15.75% per annum. For Axis Holiday Loan, you can also avail moratorium of 2 months during which you don’t have to pay any EMI on your loan.

Both salaried as well as self employed individuals are eligible for this loan. Applicant should be in age between 21 years to 60 years and should have a minimum take home income of 15 thousand per months. Basic pre loan disbursement documentation like KYC, income proof, registration proof would be required for your loan sanction. Post sanction, you would be required to complete application form, agreement, deposit NACH mandate.

Axis Bank car Loan

Axis Bank Car loan is one of the best financing offer for purchasing a new car. Axis Bank offers funding up to 100% of on road price of the car. Minimum loan amount funded by Axis Bank is 1 lakhs for a new car purchase.

Axis bank offer a reduced interest rates on financing of a electric 4 wheeler funding. Minimum documentation and fast disbursal would be done in cases where customer is already holding an account with Axis Bank.

Axis Bank car Loan Eligibility

- Salaried individuals who are between 21 years and 60 years old at the time of loan closure. Minimum net take home salary should be 2,40,000 in last year. Individual should be in continuous employment for at least 1 year. Income would be calculated from latest salary slip and form 16

- Self employed individuals between age of 18 years and 65 years having net take home annual income greater than 2 lakhs on the basis of latest ITR. Business continuity should be at least 3 years in same business.

- Self employed non individuals with business vintage of 3 years and net income of greater than 2 lakhs on the basis of ITR are eligible for car loan from Axis Bank

- Priority and wealth customers of Axis bank who have maintained relationship for at least 6 months with Axis bank are eligible for car loan. In past 2 quarter, average quarterly balance should be at least 1 Lakhs and loan eligibility would be 3 times of AQB

- Employees who are holding salary account with Axis Bank and having salary grater than 2.4 lakhs are also eligible for car loan from Axis Bank

List of documents required for Axis Bank car loan

For Individuals-

| Salaried | Self Employed | |

| Business Proof | Telephone Bill, Electricity Bill, Shop and establishment certificate, SSI or MSME registration, Current account statement, registered lease with utility bills | |

| Income Proof | Latest 2 months salary slip and latest form 16 | Latest ITR |

| Bank statement | Latest 3 months Bank statement | |

| Age Proof | PAN / Driving License/ Passport/ Birth Certificate | |

| Sign verification proof | PAN/Passport | |

| Employment/Business continuity proof | Copy of appointment letter/Reliving and experience letter/ITR or Form 16 | Shop and establishment certificate, SSI or MSME registration, Current account statement, registered lease with utility bills |

For non individuals-

| Partnership Firm/ Trust/ Society | Private Limited/ Limited Companies | |

| Business Proof | NA | |

| Income Proof | Audited Balance sheet of last 2 years | |

| Bank statement | Latest 3 months Bank statement | |

| Age Proof | NA | |

| Sign verification proof | NA | |

| Employment/Business continuity proof | Shop and establishment certificate, SSI or MSME registration, Current account statement, registered lease with utility bills | |

| Additional Documents | PAN Card/Authority letter of all partners/Board resolution of trust or society | List of Directors & Shareholding Patter/ PAN Card/ Board Resolution/ Certificate of Commencement of Business for Ltd. Co. |

Axis Bank Used Car Loan

Axis Bank offers Used car loan to eligible customers at affordable rate of interest. Minimum Used car loan amount offered is 1 lakhs rupees for a period of 5 years. LTV offered is up to 85% of resale vehicle. Axis bank also offers assistance in transfer of vehicle ownership certificate such as registration certificate. However, it is a responsibility of the borrower to hypothecate vehicle in the name of the Bank.

Axis Bank used care loan eligibility and documents required for a used card loan are same that are required for a new Axis Bank car loan.

Axis Bank used car loan interest and charges

Axis Bank offers used car loan at the rate of interest of 13.25% to 15% per annum. Processing fee charged is 6000 or 1% of loan amount whichever is higher. Moreover, documentation charges are of Rs 500.

Axis Bank charges following charges as and when applicable-

| Sr. no | Type | Charges |

| 1 | Cheque/ECS/NACH Bounce / Instrument Return Charges | Rs. 339/- per instance |

| 3 | Duplicate Statement Issuance Charges | Rs. 250/- per instance |

| 4 | Duplicate Repayment Schedule Issuance Charges | Rs. 250/- per instance |

| 5 | Duplicate No Dues Certificate / NOC | Rs. 50/- per instance |

| 6 | Penal Interest | 2% per month |

| 7 | Loan cancellation / Re-booking | Rs. 550/- per case |

| 8 | Foreclosure/Part Payment Closure | 5% of the Principal Outstanding |

| 9 | Stamp Duty | At actuals |

| 10 | Issuance of Credit Report | Rs.50/- per instance |

| 11 | Documentation Charge | Rs 500/- |

| 12 | Registration Certification Collection Charge | Rs 200/- per instance |

| 13 | Valuation Charges | Rs 590 (inclusive of GST) |

Axis Bank Loan against Car

Axis Bank offers loan against car or parallel car loan to its existing auto loan customers. Axis Loan against car offers loan amount up to 50% of existing Auto loan from Axis Bank. Documents required for Loan against car are – application form, Registration certificate of vehicle, KYC documents. Loan against car interest rates start from 16.25% charged annually and processing fee of 2% of loan amount is charged on loan amount.

Axis Bank Balance transfer and Top up car loan

Applicant can get up to 150% of existing loan from Axis Bank. Top up loan and balance transfer interest rates varies from 14.50% to 16.50% per annum and all other charges remain the same.

Axis Bank Education Loan

Axis Bank offers educational loan both for domestic as well as foreign education. Minimum loan amount financed for an education loan is Rs 50,000 and Axis education loan interest rates are between 13.70% to 15.20% charged on per annum basis.

Benefits of Axis Bank Education Loan

- Axis Bank offers education loan starting from 50,000 upwards and finance course fee, living and travelling expenses

- Easy process and lower turnaround time of close to 2 days from disbursement

- Axis Bank also provides pre admission sanction letter for a foreign university education. This letter would help a student in proving financial worthiness for his/her admission process

- Applicant, spouse, guardian can avail tax benefit under section 80E of income tax act for education loan from Axis Bank

Types of Axis Bank education loan

- Prime abroad, for full time premiere courses abroad

- Prime Domestic, for full time premiere courses in India for a tenure of 15 years

- GRE based funding for 10 years

- Income base funding for education loans up to 40 lakhs and tenure of 10 years

- Loan for higher study up to 7.5 Lakhs

- Loan for working professionals up to 20 lakhs without any collateral

Axis Bank education loan interest rates

Axis Bank offers relatively lower rate of interest for its education loan product mentioned as follows-

| Loan Amount | Rate of interest |

| Up to 4 Lakhs | 0.152 |

| Loans greater than Rs. 4 Lakhs and up to Rs. 7.5 Lakhs | 0.147 |

| Loans greater than 7.5 Lakhs | 0.137 |

Axis Bank education loan Eligibility

- Should be an Indian citizen

- Secured at least 50% marks during HSC and graduation

- Secured admission in either India or abroad for graduate and post graduate courses in engineering, medicine and management

- Co applicant having a regular source of income with documentation proof

Axis Bank education loan Documents required

- KYC documents

- Bank statement of past 6 months

- Guarantor form

- Copy of admission letter along with fee schedule

- Mark sheets of HSC, SSC and graduation courses

Documents required for first loan disbursement

- Demand letter from institute and college where admission is secured

- Complete loan agreement signed by applicant and co applicant along with annexures

- Sanction letter signed by applicant and co applicant

- Disbursement request letter signed

- receipt of the margin money paid to the college/university along with bank statement reflecting transaction

- Collateral related documents (if applicable)

- Form A2 completely signed in case of overseas education

Documents required for subsequent disbursement

- Demand letter from institute and college where admission is secured

- Disbursement request letter signed

- receipt of the margin money paid to the college/university along with bank statement reflecting transaction

- Collateral related documents (if applicable)

- Form A2 completely signed in case of overseas education

Axis Bank two wheeler Loan

Getting a bike or two wheeler of your dream financed is no more a dream with easy to obtain two wheeler loan options from Axis Bank. Axis Bank offers two wheeler loan option for standard as well as premium two wheelers brands in india. Axis Two wheeler loan require minimal documentation and faster turnaround time with attractive interest rates and higher loan amount. Moreover, Axis Bank also offers interest rebate of 50 bps for electric two wheeler loan.

Axis two wheeler loan eligibility

| Critera | Salaried | Self Employed |

| Age | 21 to 58 years | 21 to 65 years |

| Minimum income | 1.44 Lakhs per annum | 2.5 Lakhs per annum |

| Employment status | Minimum 1 year | Minimum 1 year |

| Bank statement | 3 Months Bank statement | 3 Months Bank statement |

Axis Bank Two wheeler loan documents required

| Documents required | Salaried | Self Employed |

| Office/Business proof | Telephone Bill Electricity Bill Shop & Establishment act Certificate SSI or MSME Registration Certificate Sales Tax or VAT Certificate Current A/c Statement Regd. Lease with other Utility Bills |

|

| Income Proof | Latest Salary Slip Latest Form 16 |

Latest ITR |

| Bank Statement | 3 Months Bank statement | |

| Age proof | 1. Passport 2. Driving License 3. Birth Certificate 4. Pan Card | |

Axis Bank Two wheeler loan rate of interest

For two wheeler loans, Axis Bank charges rate of interest from 10.80% to 28.30% depending upon the profile of the customer. Interest rate on two wheelers loans are updated each quarter and ROI for two wheeler loan is around 18.30%. Two wheeler loan’s tenure varies from 12 months and goes up to 48 months. However, for superbikes that have a higher engine capacity greater than 500cc, loan tenure can go up to 60 months.

Axis Bank also offers to purchase a super bike with engine capacity greater than 500cc. You can get finance up to 85% of bike value by visiting your nearest branch.

Axis Bank Loan against property

Axis Bank Loan against property offers an opportunity to unlock hidden value of your residential and commercial property. Loan amount offered in LAP ranges from 5 lakhs to 5 Crores. List of eligible individuals and entities for LAP from Axis Bank are-

- Salaried individuals who are 24 years or more at the time of application and working in a reputed private limited or a government organization

- Self employed individuals who are filing ITR and minimum 24 years old.

- Professionals such as cost accountants, chartered accountants, Doctors, consultants

Margin requirements for Axis LAP varies from 20%-30% for purchase of commercial property and 40%-55% margin requirement for loan against commercial property.

Axis Loan against property documents required

- KYC documents – Basic KYC documents as mandated by RBI are required for Axis Bank loan login. These documents are known as OVD and consists of Passport, Driving License with photograph, Proof of possession of Aadhar number or Aadhar number, Voter ID issued by election commission, Job Card by NREGA signed by an officer of the State Government, Letter issued by the National Population Register containing details of Name, Address

- Proof for Date of Birth – Date of birth is required by Axis Bank to calculate age eligibility. These documents are considered as valid proof for date of birth such as Passport, Driving License with photograph, Proof of possession of Aadhar number or Aadhar number, Voter ID issued by election commission, birth certificate or a school leaving certificate.

- Signature Proof – Any one of the following documents are accepted as Axis Bank personal loan documents for signature proof. They are – Passport with photograph, PAN card, banker’s verification documents

- Income Proof – Income proof is required to calculate loan eligibility. You would be required to send latest 2 months salary slips, latest 2 months bank statement with salary credits and Employment proof

- Balance Transfer /Takeover of Loan – Latest 12 months statement of account and repayment schedule from the existing bank or financial institution

- Proof of Income – Income proof is required for eligibility calculations. For salaried customers, 3 months salary slip, bonus proof along with 6 months bank statement showing salary credits is required. For self employed individuals, 2 yrs ITR, Computation of Income, P&L, Balance sheet with CA seal and sign along with Tax Audit Report (If Gross Turnover Exceeds Rs 1 Cr or Gross Receipts Exceeds 25 Lac) is required at minimum. Along with above documents, 6 months bank statement along with CPC and tax paid challan would be required if ITR is filed without digital sign. For self employed individuals, business continuity proof for at least 3 years would be required at documentation stage.

- For applicants who are either partner or director – If applicant is a partner in a partnership firm then following documents would be required – Partnership deed, List of partners, NOC as per Axis bank standard, Partnership firms audited ITR along with complete financials, partnership authority letter on the letterhead of firm if firm stands as guarantor in the loan. If applicant is a director in the firm then 2 years ITR along with computation of income, P and L, Balance sheet with CA sign. Tax audit report, Board resolution on letter head of the company in case company is the applicant, Certificate of incorporation, MOA, AOA, DIN of all directors, latest shareholding and list of directors signed by company secretary or authorized signatory.

Documents required for Lease rental discounting

- 6 months bank statement where rent is deposited by tenant

- Registered lease agreement signed between tenant and landlord

- Recent 2 years ITR with audited balance sheet, P and L statement with CA sign

- Recent form 26AS

- For partnership cases, partnership deed along with Partnership ITR and partnership authority letter

- For Corporate cases, Board resolution along with Company ITR, MOA, AOI and certificate of incorporation would be needed

Proof of Income for Loan against property

- Salaried – Latest 3 months salary slip, appointment letter along with 6 months bank statement

- Self Employed – Latest 2 years ITR along with computation of income, P and L, balance sheet along with CA sign. Additionally, Tax audit report along with 6 months bank statement and CPC/tax paid challan would be required

- NRI Salaried – 3 months salary slip along with appointment letter overseas credit report, valid visa copy, passport copy and POA would be required

Axis Bank Loan against property interest rates

| Term Loan | LAP ROI |

| PSL | 7.90%-8.30% |

| NON PSL | 7.95%-8.35% |

| OD | LAP ROI |

| PSL | 8.90%-9.25% |

| NON PSL | 8.95%-9.30% |

Axis Bank Lease rental discounting

Axis Bank offers lease rental discounting, commonly known as LRD to individuals as well as non individuals who wants to earn extra cash by utilizing rental income received from corporate clients. This loan is offered only if lessee is a corporate. Interest rate for lease rental discounting are upwards of 11% per annum with loan tenure of up to 9 years.

Documents required for lease rental discounting are similar to what is required for Axis Bank Loan against property. Applicant need to completely fill application form along with necessary documents to avail this loan facility.

Axis Bank overdraft against property

Axis Bank offers a baseline overdraft facility against property. This overdraft can be enhanced on the basis of repayment behavior of the customer. Overdraft facility helps in needs of a business by offering timely cash. Documents required for an overdraft facility have been mentioned earlier in our loan against property section. OD limit interest rate is floating in nature.

Axis Bank Gold Loan

Now, you can unlock hiddenpower of the gold at your home by taking a Gold Loan from Axis Bank. You can get a loan from 25000 to 25 Lakhs against gold that you have. Gold Loan interest rates varies from 13.50% to 14.50% per annum.

Features of Axis Bank gold loan are –

- Gold Loan amount from 25 thousand to 25 Lakhs

- Loan disbursal on the same day

- Loan tenure from 6 months to 36 months

- Gold Loan against hold ornaments and gold biscuits

- Total safety of gold as they are kept in safe bank vaults

Axis Gold Loan documents

- KYC documents – Basic KYC documents as mandated by RBI are required for Axis Bank loan login. These documents are known as OVD and consists of Passport, Driving License with photograph, Proof of possession of Aadhar number or Aadhar number, Voter ID issued by election commission, Job Card by NREGA signed by an officer of the State Government, Letter issued by the National Population Register containing details of Name, Address

- Proof for Date of Birth – Date of birth is required by Axis Bank to calculate age eligibility. These documents are considered as valid proof for date of birth such as Passport, Driving License with photograph, Proof of possession of Aadhar number or Aadhar number, Voter ID issued by election commission, birth certificate or a school leaving certificate.

- Signature Proof – Any one of the following documents are accepted as Axis Bank personal loan documents for signature proof. They are – Passport with photograph, PAN card, banker’s verification documents

- Income Proof – Income proof is required to calculate loan eligibility. You would be required to send latest 2 months salary slips, latest 2 months bank statement with salary credits and Employment proof

Additionally, you would be required to complete Gold Loan application form along with KYC documents. Axis Bank can ask for additional documents as it deemed fits to required. Axis Bank offers gold loan LTV up to 75% of Gold value. Gold Loan interest rates are set in every quarter.

Axis Bank Loan against securities

Axis Bank offers loan against securities for wide variety of securities such as demat shares, equity mutual funds, debt mutual funds and Bond etc. Unique features of Axis Bank loan against securities are –

- You need to pay interest only on amount utilized

- Can get a loan amount minimum of 25000 for equity, 1 lakhs for debt mutual fund and 50 thousand for bonds

- Loan against security interest rates of 10.50%

- One can also avail overdraft facility up to 60% of NAV of equity mutual fund, 50% of share value, 85% of debt mutual fund, 75% of surrender value of life insurance policies

- No prepayment charges on loan pre payment

Axis Bank Loan against securities eligibility

- Axis Bank customers with demat account associated with Axis securities

- Resident Indians with age greater than 18 years

- HUF, Private limited companies, partnership firms, sole proprietorship firm

Axis Bank loan against securities documents

- KYC documents

- Latest statement for holding of mutual funds, shares, insurance policy etc

- Pledge for the creation of pledge

- Guarantor form, which is optional

Loan against securities interest rates varies from 10.50% to 12.75%.

- Complete list of securities approved for LAS

- Approved Mutual fund schemes for LAS

- Approved single script shares

- Approved list of bonds

- Approved Life insurance companies for Loan against securities