GST website registration guidelines

GST website registration guidelines

Continuing with our series on FAQs on new GST registration India. Let us now go through part 3 of GST registration FAQs. In this article , we would delve into FAQs related to landing page on GST website during new GST registration. All important questions related to a landing page would be answered in this article. Before reading this article, you can also check out our previous FAQs on fresh GST registration. Without wasting any more time, let us dive straight into our FAQ on landing page FAQs-

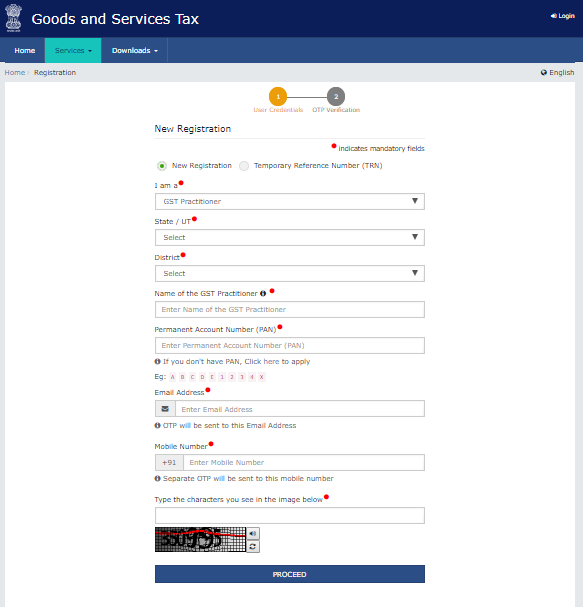

I am on the landing page of the New Registration Application on GST website and there are two radio

I am on the landing page of the New Registration Application on GST website and there are two radio

buttons – New Registration and Temporary Reference Number (TRN). Which one do I need to select?

Select New Registration Application. If you have a valid TRN, select Temporary Reference Number

I am applying for a new registration. Which state should I select?

Select the state in which you are applying for the registration. (State once selected in Part A cannot be changed at later stage)

My principal place of business is in State X but I am applying for a new registration for State Y. Which state should I select?

Select the state in which you are applying for the registration (registration is state-specific)

In the field for PAN, do I need to put my own PAN or the PAN of the business?

Please enter the PAN of your business. In case of proprietor, please provide your personal PAN.

Whose e-mail ID and mobile number should I give?

Please give details of the Primary Authorized Signatory.

What is Captcha Code? Why do I need to fill it?

Captcha Code is a numeric code that must be filled every time a taxpayer login to the GST website.

It has been added as an additional security measure.

What is a TRN?

TRN or Temporary Reference Number is a unique 15-digit reference number that allows you to

access your new registration application on the GST Portal in the pre-login mode (without valid

login credentials).

TRN is generated when you successfully submit all the fields of PART A (first page) of the new

registration application and successfully validate your mobile number and e-mail ID by correctly

entering the respective OTPs.

Your TRN is sent to you via SMS and e-mail.

Now that I have generated my TRN, how do I begin filling PART B of my new registration application on GST website?

Please go to the New Registration page and select the radio button Temporary Reference

Number. Now enter your TRN and click PROCEED. A new page will open where you will have to

enter the Mobile OTP and e-mail OTP which will be sent to you when you click PROCEED. Enter

the respective OTPs and you will be directed to the landing page of PART B of the New

Registration Application (Business Details section).

I did not write my TRN or I have forgotten my TRN?

Your TRN is also sent to you via SMS and e-mail.

I did not write my TRN and I also deleted the SMS and the e-mail that were sent to me.

What do I do now?

In such a case, you will have to fill in all the details in PART A again. Upon completing the process, a message will be displayed ‘You already have a TRN generated with this combination’. Be sure to save the TRN this time!

It has been more than 15 days since I generated a TRN. Can I still access my new

registration application?

In such a case, you will have to fill in all the details in PART A again. Upon completing the process, a message will be displayed ‘You already have a TRN generated with this combination’.

In this article, we have discussed various FAQs related to landing page on GT website during GST registration. You can contact us on this link for further guidance or go through our previous posts on related topics.