Contents of IEPF form 5 to claim unclaimed dividend

IEPF stands for Investors education and protection fund. Investor Education and Protection Fund (IEPF) is for promotion of investors’ awareness and protection of the interests of investors. It was setup protect interests of investors in securities markets. This fund was setup by Government of India

Individuals, whose unclaimed dividends / shares have been transferred to IEPF, may claim the same as well as the corresponding dividend by making an application to the IEPF Authority, in Web Form No. IEPF form 5 available on www. iepf.gov.in. The shareholder can file only one consolidated claim in a financial year as per the IEPF Rules.

Individuals, whose unclaimed dividends / shares have been transferred to IEPF, may claim the same as well as the corresponding dividend by making an application to the IEPF Authority, in Web Form No. IEPF form 5 available on www. iepf.gov.in. The shareholder can file only one consolidated claim in a financial year as per the IEPF Rules.

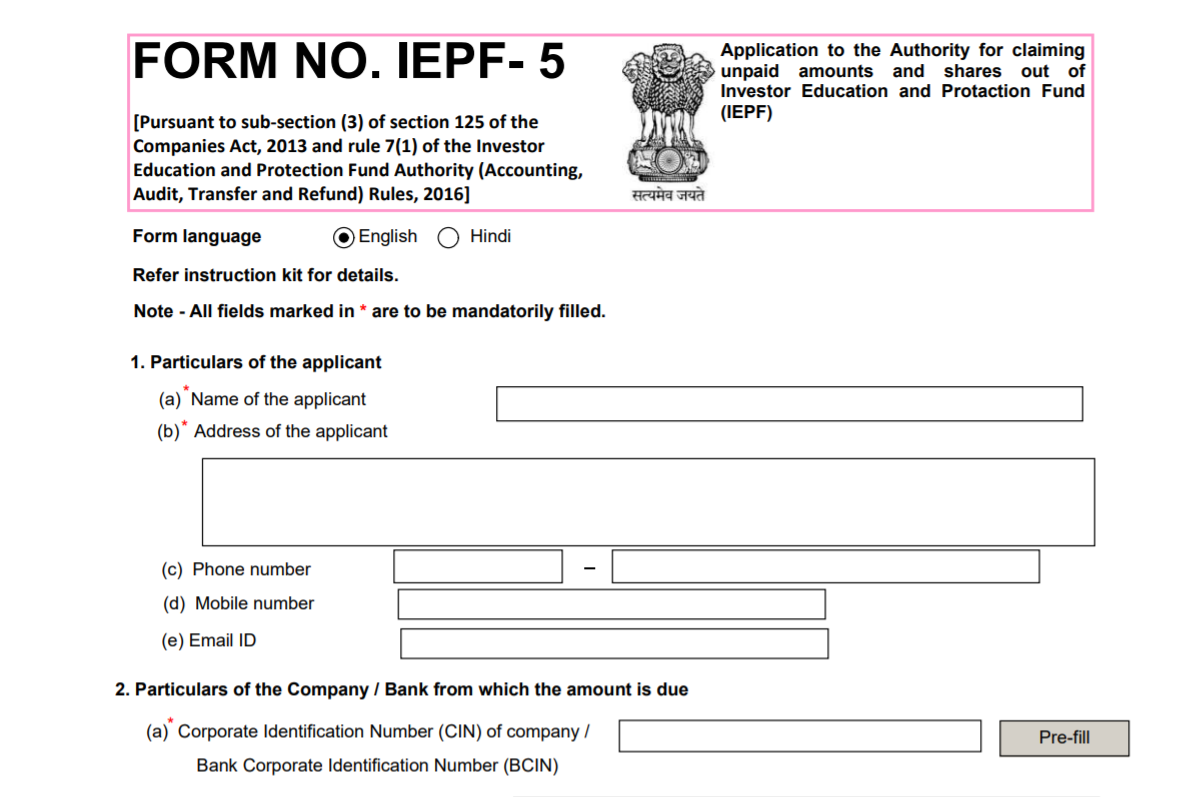

Contents of IEPF form 5

Let us see various content that are needed to be filled in IEPF form 5-

- Particulars of the applicant – Enter Name, Address and contact details of the

Applicant. - Particulars of the Company from which the amount is due – Enter the Valid CIN of the company. You may find CIN by entering existing registration number or name of the Company in the ‘Find CIN’ service under the menu MCA Services on the MCA website. (www.mca.gov.in)

Click the Pre-fill button. Upon clicking the button, system shall automatically display the name,

registered office address and email id of the company. In case there is any change in the email ID, you can enter the new valid email ID which would be updated in MCA records upon processing of this IEPF form 5. - Details of shares claimed – Enter the details of shares including folio id, etc

- Details of Amount Claimed – Enter the details of amount claimed. Enter the number of claims made. The number of rows under ‘Year wise details of securities/ deposits for which the amount is claimed’ shall be generated based on the number of claims entered by the applicant in IEPF form 5

- Aadhar Number or Passport/OCI/PIO Card No. (in case of NRI/foreigners) – Enter aadhaar number of applicant in case of Indian National. For foreign nationals, enter OCI/PIO Card no

- Details of bank account (Aadhar linked, in case applicant is not NRI/foreigner) in which refund of claim to be made – Enter bank account number, bank name, Bank branch, Type of account and IFSC code. In case of Indian Nationals, Bank Account Number must be Aadhaar linked.

- Demat Account Number – Enter Demat Account Number

In this article, we have discussed contents of IEPF form 5 that is required to be filled to claim unclaimed dividend from IEPF. To know more about IEPF you can visit our detailed post here.