HDFC Loan against assets

HDFC Loan against Assets

Table of Contents

In our previous article on personal loan offering from HDFC Bank, we have discussed various personal loans offerings including personal loan, housing loan from HDFC Bank. HDFC Bank offers these loans at an attractive rate of interest and higher tenure. These loans are offered at faster turnaround time and in a complete digital manner.

Now, we will discuss various HDFC Loan against assets offered by HDFC for consumers. Let us look at these products in detail-

HDFC Loan against credit card

Now, you can get a loan on your credit card and can fulfill your various previous needs at just click of a mouse. Credit card loans are offered instantaneously in a complete digital manner. Various features of HDFC Loan on credit card are mentioned below-

- This loan is only for existing HDFC Bank’s credit card holder and it is a pre approved loan offered for credit worthy customers of HDFC Bank

- Tenure for this loan is between 12 to 60 months. Higher tenure would reduce your monthly emi burden but would increase your interest component.

- It is a pre approved loan offered only to HDFC bank customer and hence no additional paperwork is required to be done for availing this loan.

- Amount will be credited in your HDFC Bank savings account on the same day

- To apply for a loan on your HDFC credit card just visit your HDFC Bank online portal and apply under credit card

HDFC Bank salary plus loan

HDFC Bank offers a unique credit line for its salary account holder. If you have salary account with HDFC bank then you can a get a loan amount up to 3 times your monthly salary in your bank account. maximum loan amount eligible under HDFC Bank salary plus is 1.25 lakhs. various features of salary plus loan are-

- Loan would be disbursed in the form of a credit limit on your salary account and interest would be charged only on the amount utilized or taken from the credit limit.

- Credit limit is extended for a period of up to one year. Limit can be renewed post completion of one year by paying nominal fee of 250 at the end of 12 months.

- This facility can be availed by visiting HDFC Bank portal and click on on offers tab

- HDFC Bank salary plus loan interest rates varies from 15% to 18% per annum. For complete lost of charges and fees you can visit the website here.

HDFC Bank Gold Loan

HDFC Bank offers gold loan to its existing as well as new customers at attractive interest rates. Gold is of the most traditional asset that can help in generation of cash in the time of need for the gold holder. You can put your gold with a bank and can avail a gold loan at a certain value of the gold. Various exciting features of a HDFC Bank Gold loan are-

- HDFC offers a tenure up to 24 months for its Gold loan and tenure starts from 3 months.

- You need to pay interest only for the amount utilized from the gold loan

- HDFC Bank gold loan interest rates varies from as low as 7.75% to 16% depending upon the profile and credit worthiness of the customer

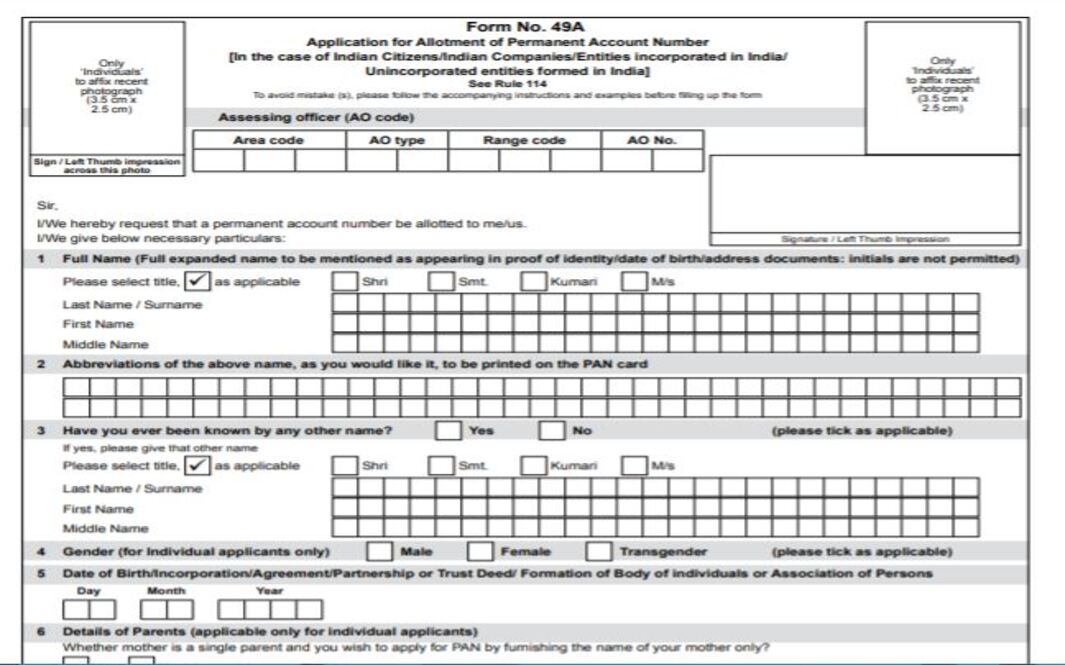

- Documents required for gold Loan are pretty basic in nature such as – Driving License, Voter ID, Aadhar card, PAN card, passport size photograph etc.

Although, there are plenty of NBFCs and banks that offers gold loan in the market but HDFC Bank offers Gold Loan at attractive rate of interest and doesn’t have any other hidden charges. Complete list of fees and charges for HDFC bank Gold Loan can be found from this link.

HDFC Bank Loan against securities

HDFC Bank offers complete digital loan against securities such as Loan against shares, loan against mutual funds, Loan against insurance policies etc. You can avail loan against securities in a complete digital manner and with lower margin compared to other banks.

Approved securities for loan against shares

- Equity shares with loan up to 50% value of shares

- Mutual funds with 50% to 80% value of latest NAV of mutual funds

- 80% value of surrender value of insurance policies

- 70% value of Kisan Vikas Patra and National saving certificate

Loan against securities offers a easy repayment options to borrower with one condition that these loans can not be used to purchase a stock or a mutual fund. You would be charged interest only on the amount used by you and not on the total amount.

HDFC Bank offers loan against shares only to existing customers of HDFC Bank holding current or saving account. HDFC Bank loan against securities interest rate varies from 8% to 12% for its customers. For complete list of charges and fee for HDFC Bank loan against shares, you can visit this page.

Documents for Loan against securities

- KYC documents – Basic KYC documents as mandated by RBI are required for Axis Bank loan login. These documents are known as OVD and consists of Passport, Driving License with photograph, Proof of possession of Aadhar number or Aadhar number, Voter ID issued by election commission, Job Card by NREGA signed by an officer of the State Government, Letter issued by the National Population Register containing details of Name, Address

- Proof for Date of Birth – Date of birth is required by Axis Bank to calculate age eligibility. These documents are considered as valid proof for date of birth such as Passport, Driving License with photograph, Proof of possession of Aadhar number or Aadhar number, Voter ID issued by election commission, birth certificate or a school leaving certificate.

- Signature Proof – Any one of the following documents are accepted as Axis Bank personal loan documents for signature proof. They are – Passport with photograph, PAN card, banker’s verification documents

- Income Proof – Income proof is required to calculate loan eligibility. You would be required to send latest 2 months salary slips, latest 2 months bank statement with salary credits and Employment proof

Digital Loan against mutual funds

You can also avail loan against mutual funds in a complete digital manner with a complete online process from HDFC Bank. HDFC Bank offers a complete digital loan for certain mutual funds at close to 80% of latest NAV for debt mutual fund. However, loan amount offered for a equity mutual fund is slightly lower as compared to a debt mutual fund but still with this loan, you would not be required to liquidate your units.

Mutual funds of following asset management companies are eligible for mutual fund loan from HDFC Bank-

1. Aditya Birla Sun Life Mutual Fund

2. DSP Blackrock Mutual Fund

3. HDFC Mutual Fund

4. HSBC Mutual Fund

5. ICICI Prudential Mutual Fund

6. IDFC Mutual Fund

7. Kotak Mahindra Mutual Fund

8. L&T Mutual Fund

9. SBI Mutual Fund

10. Tata Mutual Fund

Loan against rental receivables

HDFC Bank also offers loan for commercial property owners who have rented or leased out their commercial property or shop to reputable institutions and organizations such as banks and private offices. One can get a loan amount up to 50% of value of commercial property if you are renting or leasing the same.

Documents required for loan are-

- Proof of address

- Proof of identity

- 12 months bank statement in which rentals are being credited

- Property documents

Loan against property

HDFC Bank offers a exciting loan on your existing residential and commercial property. You can get loan on your property at attractive rate of interests and higher tenure. HDFC Bank offers loan amount up to 65% of your property valuation. Salient features of Loan against property from HDFC Bank are-

- Loan is available for both residential as well as commercial property

- Loan amount can be used for variety of purposes such as expansion of business, starting a new trade or expenses for a marriage. There is no restriction on end use for the loan until or unless loan amount is used for illegal activities such as gambling or buying a lottery.

- Both salaried and self employed profiles are eligible for this loan

- It works as a tremendous source of additional liquidity which cant be arranged in a normal course of business

- HDFC Bank has a transparent process of documentation and all your property related documents would be kept safe in the HDFC bank lockers. You don’t have to worry about misplacement of your property documents

- HDFC Bank charges a very rate of interest and other charges such as pre payment or foreclosure charges

- Rate o interest or ROI for HDFC Bank loan against property (LAP) varies from 6.5% to 11% per annum and it is one of the lowest rates offered by banks in industry. NBFCs can charge ROI as high as 15%-25% for loan against property on their book.

Documents required for a LAP from HDFC Bank

Following documents would be required to be submitted with HDFC Bank for obtaining a LAP from HDFC Bank-

Documents for self employed

| Identity proof | PAN Card/Driving License/ Passport/ Voter’s ID/ Aadhaar Card |

| Ownership proof | Agreement Copy / Electricity Bill / Maintenance Bill with share certificate / Municipal tax bill/Share certificate |

| Firm Constitution | MOA/Partner Ship Deed/GST Registration Certificate |

| Banking | Last six months bank statement (Business Accounts) |

| Address Proof | Passport/Driving License/Voter’s ID/Aadhaar Card/Utility Bill/Bank Statement/Bank Account Passbook (Updated and no more than 3 months old) |

| Business continuity proof | Shop and Establishment certificate/Tax registrations-VAT/Service tax/GST registrations |

| Financial | 1.Latest two years financials of the firm with turnover of greater than Rs 2 Crores |

| Tax | 2.Latest Tax Audit Report. |

Documents for Salaried

- KYC documents – Basic KYC documents as mandated by RBI are required for Axis Bank loan login. These documents are known as OVD and consists of Passport, Driving License with photograph, Proof of possession of Aadhar number or Aadhar number, Voter ID issued by election commission, Job Card by NREGA signed by an officer of the State Government, Letter issued by the National Population Register containing details of Name, Address

- Proof for Date of Birth – Date of birth is required by Axis Bank to calculate age eligibility. These documents are considered as valid proof for date of birth such as Passport, Driving License with photograph, Proof of possession of Aadhar number or Aadhar number, Voter ID issued by election commission, birth certificate or a school leaving certificate.

- Signature Proof – Any one of the following documents are accepted as Axis Bank personal loan documents for signature proof. They are – Passport with photograph, PAN card, banker’s verification documents

- Income Proof – Income proof is required to calculate loan eligibility. You would be required to send latest 2 months salary slips, latest 2 months bank statement with salary credits and Employment proof

Apart from these documents, HDFC Bank would also require you submit complete chain of property documents up to 13 years chain at least.

In this post, we have discussed in detail about various loans against assets that are offered by HDFC bank to individuals and self employed persons. HDFC Bank is known for its faster turn around time and lower interest rates compared to other banks. If you are interested in knowing about business loan offering by other banks then you can visit following links-

- SBI Business Loan

- HDFC Business Loan for traders

- ICICI Business Loan

- Axis Business Loan

- Axis Mudra Loans

- PNB Business Loan

- Kotak Mahindra Business Loan

- Yes Business Loan