Documents required for HDFC Home Loan

HDFC is one of the pioneer in Home Loan industry and it is one of the largest lender when it comes to Home Loan in India. HDFC has one of the fastest process and turn around time for a Home Loan application. If you want to apply for a HDFC Home Loan or want to know more about recent HDFC Home Loan interest rates then you can visit our website for more info. In this post, we would look into list of documents required for HDFC Home Loan.

An individual must submit following list of documents for applying at HDFC-

- KYC Documents

- Proof of income

- Property documents

KYC Documents for Home Loan

- Recent passport size photograph

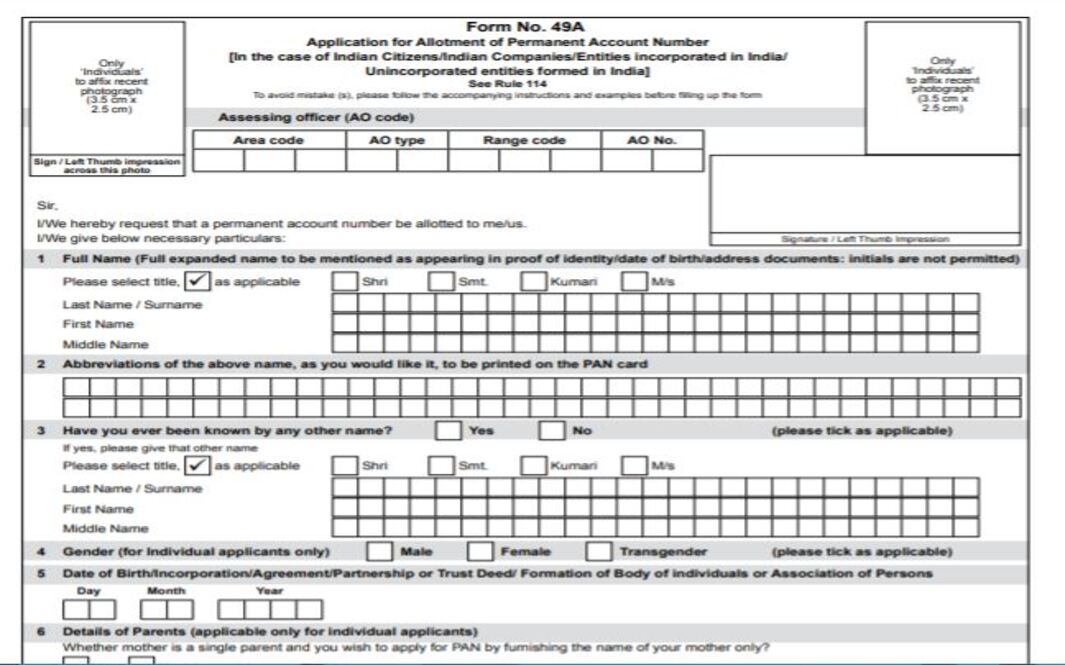

- Any one Proof of Identity from these documents (PAN Card/ Passport/ Aadhar Card/ Driving License/ Voters ID Card)

- Any proof of Residence from these documents(Ration Card/ Electricity Bill/ Telephone Bill/ Passbook or Bank Statement with address/ Employment Letter)

- Any age proof documents mentioned here (Passport/ PAN Card/ Birth Certificate/ Bank Passbook/ Driving License/ 10th Marksheet)

Proof of Income for a HDFC Home Loan

Proof of Income is one of the most important documents required for applying to any type of loan. proof of income is used for calculating repayment capacity of the borrower and his credit worthiness. It is important to make sure that proof of income is a recent one and should be in the format as desired by financial institution. Following are the acceptable proof of income documents for a HDFC Home Loan-

- Latest 3 months Salary Slips of the current organization

- Bank Account Statement of past six months reflecting the salary credit of past 3-6 months

- Form 16 (Part A & Part B) and filed Income Tax Returns (ITR) of the past two years

- Employee Identity Card if available

- Appointment Letter/ Employer Certificate/ Increment Letter (as required)

For complete list of proof of income documents, you can visit official HDFC website.

Above mentioned list are the documents that are required for a salaried customer. However, if you are a self employed customer then following documents would be required for a Home Loan process-

- Latest 3 year ITR with complete financial statements filed by the individual. One should make sure that there is a gap of at least 6 months between filing of two ITRs

- 6 months bank statement of the current account or CC account from which most of the business transactions are routed

- Registration certificate for the business

- Recent GST returns

- Lates 3 years audited financial statements

Property documents required

Property documents are the backbone of any home loan application. Your final loan amount would be affected mostly by property’s market value. Property documents are also required to make sure that there is claim over the property and title for the property is clean. HDFC requires following property documents for a Home Loan application-

- Commencement Certificate – A commencement certificate is a document provided by local municipal corporation permitting builder to start construction of real estate

- Registered agreement for sale – It is an agreement between buyer and seller to purchase a given property at a specified price. This agreement to sale need to be registered at local registrar.

- Approved building plan copy – Building plans are need ed to be approved by local municipal corporation so that no one could claim this in future

- Payment receipts to the builder – If payment has already been made to builder then receipts for the same should be on record of HDFC

- Registration receipt – Receipt provided by local authority post registration

- Sanction Letter

- Chain contract from the previous owner

- Occupancy Certificate – This certificate is issued by local corporation and it states that building is safe for occupancy

- Society maintenance bill copy

- Society Share Certificate

- Society Registration Certificate

- Possession Letter / Allotment Letter

- Copy of electricity bill

- NOC (No Objection Certificate) from society

- Property Insurance copy

In this post, we have look into various documents that are required for a HDFC Home Loan process. If you are interested in Home Loan and want to read more about the same then you can visit followings links-

- State Bank of India Regular Home Loan

- State Bank of India Home Loan interest rates

- State Bank of India Home Loan EMI Calculator

- State Bank of India MaxGain Home Loan

- SBI Top up Loan

- How to apply for SBI Home Loan

- Current SBI Home Loan interest rates 2022

- How to apply for HDFC Home Loan

- Current HDFC Home Loan interest rates