Bank of Baroda Loan

Bank of Baroda is one of the largest banks in India. Bank of Baroda is known for its overseas bank operations apart from tremendous branch network in India. A business can gets its financing needs fulfilled by a Bank of Baroda Loan. Bank of Baroda offers various types of loan products to serve business financing needs of all type of customers. Let us look at various types of Loans offered by Bank of Baroda in this article-

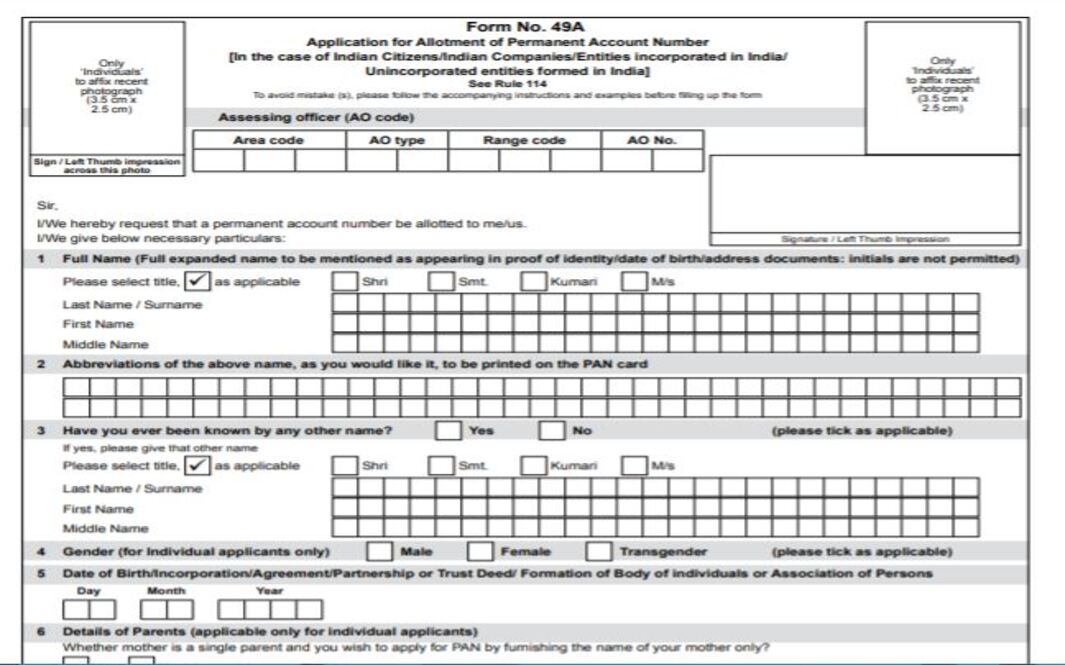

Digital mudra Loan – BOB offers Mudra Loans to MSMEs established in India. Loan up to 10 lakhs can be availed under this scheme. This loan is availed by entities involved in trading, manufacturing and services sector. Basic requirements for this loan includes PAN details, GSTIN number, last 6 months banking statement, proof of identity and proof of address. Bank of Baroda Mudra Loan can be availed by proprietor, private limited company or a partnership etc.

Digital MSME Loan – Digital MSME loans are an unique offering by Bank of Baroda for its MSME customer. These loans are given to micro, Medium and Small enterprises for a tenure of 12-60 months. Loan eligibility criteria is similar to Bank of Baroda Mudra Loans.

Baroda Energy Efficiency Project (BEEP) Finance – This is a loan that is offered to Energy service companies or ESCOs. maximum loan amount that can be availed under this Baroda Loan is 15 Crores. This loan is guaranteed by SIDBI and minimum collateral required for this loan is 25% of loan amount. payments and receipts for these loans are routed through Escrow account.

PM Svanidhi Scheme – Maximum loan amount of Rs 10,000 is provided to street vendors identified in survey and in possession of Certificate of Vending / Identity Card issued by Urban Local Bodies (ULBs).

Baroda arogyadham loan – This loan is provided to setup or renovate a hospital or a medical facility. Additional requirement fulfilled by this loan is purchase of medical equipment and stock of medicines.

Bank of Baroda Artisan credit card – Artisans involved in manufacturing/production process are eligible for this loan. Maximum credit limit of Rs 2 Lakhs is provided to artisans registered with local commissioner

Bank of Baroda loan is a one top solution for all of your financing needs and these loans are offered to virtually every business registered in india. Bank of Baroda has a pretty simple appraisal process with easy documentation and application.

If you want to read more about business loans offered by other major banks then you can visit following articles.

- SBI Business Loan

- HDFC Business Loan for traders

- ICICI Business Loan

- Axis Business Loan

- Axis Mudra Loans

- PNB Business Loan

- Kotak Mahindra Business Loan

- Yes Business Loan