Personal Loan EMI Calculator

Personal loan is one of the most popular loan offering from most of the Indian private as well as private sector bank. Personal loan is a loan that is unsecured in nature and is offered in the form of a term loan with repayments divided into equated monthly installments or EMI. An Personal Loan EMI Calculator is an easy to use utility that enables individual applicant to calculates its personal loan emi for a specific tenure. In this article, we would look into detail of working of an EMI calculator

Components of an EMI

An EMI consists of two components mainly principal and interest. Interest is the amount simple interest that a bank would charge on a closing principal on the date. With time, your principal component would reduce and thus interest charged on that principal would also reduce. One benefit of an EMI is that at the end of tenure. principal would always reduce to zero and EMI also provide a facility of repaying your loan in a structured manner with timely deduction of EMI from bank accounts.

Let us look at the workings of a business loan EMI calculator. AN EMI calculator is an easy utility that can be used to calculate an EMI for your loan

Personal Loan EMI calculator on Excel

You can easily calculate your personal loan EMI with the help of Microsoft Excel program. For calculation your loan EMI, you would be required to use PMT function in Excel. Working of PMT function is shown below –

| Rate | 1% |

| Nper | 60 |

| PV | 1000000 |

| EMI | ₹ 21,247.04 |

In above example, Excel based Personal loan EMI calculator has calculated EMI for a Rs 10 lakhs loan at the rate of 10% per annum for 60 months. Care should be taken to take uniform numbers while inputting formula. For example, if duration chosen is in months then rate of interest should also be inputted in months.

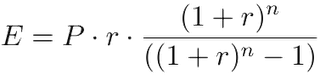

Business Loan EMI calculator foundation

where

E is EMI

P is Principal Loan Amount

r is rate of interest calculated on monthly basis. (i.e., r = Rate of Annual interest/12/100. If rate of interest is 10.5% per annum, then r = 10.5/12/100=0.00875)

n is loan term / tenure / duration in number of months

In most of the personal loan products in the market, interest is usually charged on the reducing balance. Due to this reason, interest component of the EMI would gradually increase with time and principal would similarly reduce.

In this article, we have seen working and foundation for an EMI calculator used by industry. If you want to read more about personal loan, you can visit our detailed articles on personal loan here.

Frequently asked questions (FAQs)

Q – What is the EMI for a 3 Lakhs personal loan?

A – EMI for a 3 Lakhs personal loan with ROI of 15% and tenure of 3 years, EMI would come out to be Rs 10,400

Q – What is the EMI for a 50,000 Loan?

A – EMI for 50,000 personal loan is Rs 1,733

Q – How much personal loan can i get if my salary is 40,000?

A – you can get a personal loan up to 15 Lakhs if your monthly salary is Rs 40,000

Q – What is the EMI for a 5 Lakhs personal loan?

A – EMI for a 5 Lakhs personal loan is Rs 17,333

Q – How much personal loan can i get if my salary is 50,000?

A – You can get a personal loan up to amount 18 Lakhs

Q – How much personal loan can i get if my salary is 75,000?

A – You can get a loan up to 30 Lakhs for a salary of Rs 75,000

Q- How can i check my personal Loan EMI?

A – You can check your personal loan EMI by visiting your bank’s website and logging into your account. Under Loan, you would see your monthly EMI

Q – What is the minimum salary for a personal loan?

A – Minimum salary for a personal loan is Rs 15,000 – Rs 20,000 in most of the banks.