4 Important methods to track PAN status

How to track PAN status

Table of Contents

PAN number is one of the most important numbers that you can get against your individual or entity. PAN number is an identity number given for an individual or entity. PAN number is a 10 digit alphanumeric number that is given by the Income Tax department that is valid for a lifetime.

PAN number contains information such as name of the card holder and name of the father of the applicant. Apart from these information PAN contains date of birth, PAN number and photographs of PAN holders.

Application for a PAN number

You can apply for a new PAN number or a change in PAN number in multiple ways. You can apply for a new PAN either with an online or offline method. You can apply for a new PAN number official PAN TIN NSDL portal or UTIITSL portal.

Application for a PAN online is quite a simple process in which you need to fill form 49A along with scanned copies of mandatory documents on NSDL portal. If you want to apply for a PAN card in offline mode then you need to download form 49A and fill it completely. Send this application form along with mandatory documents to NSDL office

Various methods to track PAN card

Authorities have provided multiple methods to check PAN card. You can check PAN card status with help of Aadhar number, PAN number, date of birth, acknowledgement number etc.

Most important methods to track PAN card are –

- Track PAN Card with PAN or Coupon Number on UTI Website

- Track PAN card using 15 digit Acknowledgement number on NSDL portal

- Check your PAN card status without an acknowledgement number on NSDL portal

- PAN card track through Name and Date of Birth

- Track your PAN application status Using Call

- Track Pan Card Application Status Using SMS Service

- Track PAN Card by Aadhaar Number

We have already discussed how you can check PAN card status on NSDL portal and UTIITSL portal. You can check the procedure to check PAN card status on NSDL portal and the procedure to check PAN status on UTIITSL portal. Let us look at other mode to track PAN card

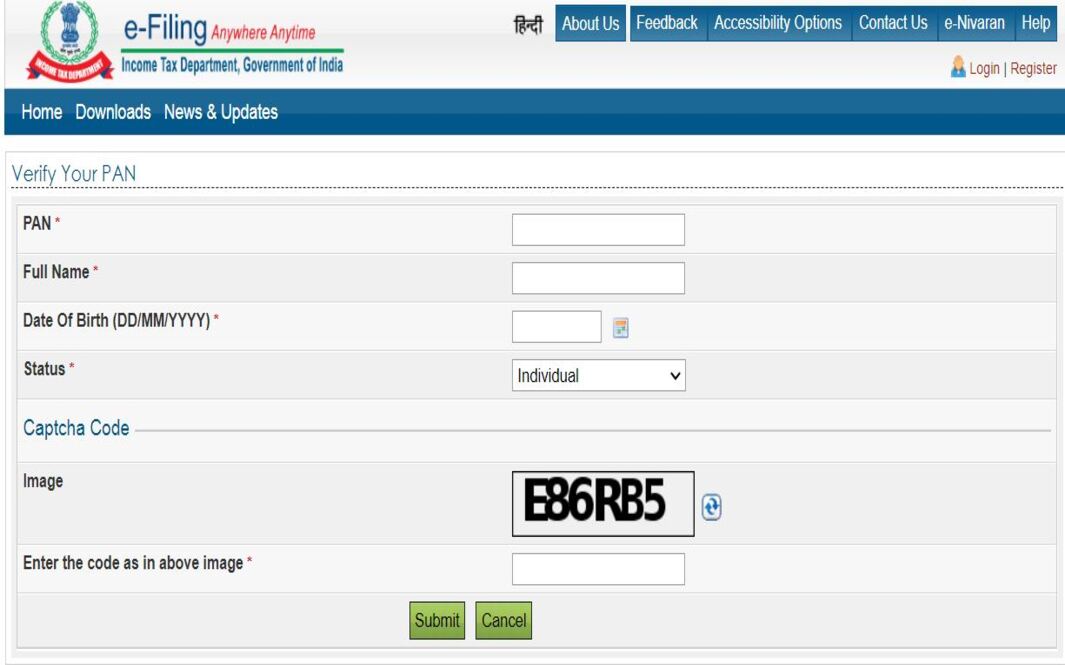

How to check PAN status on Income tax website with name and date of birth

You can check the status of existing PAN cards on the Income Tax India portal. This portal would provide information like whether PAN is active or not, data exists or not. If you want to verify weather a PAN card exist or not then you need to follow these steps-

Step 1 – Visit official Income tax India filing website here

Step 2 – Now click on “verify PAN details” tab on portal

Step 3 – Enter information like name, PAN and date of birth.

Step 4 – Choose your status. If you are an individual then choose Individual

Step 5 – Enter Captcha code and press submit button

Post clicking on the submit button, your status would be displayed on screen. If you PAN is active then following status would be displayed on screen “Your PAN is Active and the details are matching with PAN Database”

Track PAN card status with a phone call

Now, you can check your PAN card status with a phone call too. It is one of the most easier and less time consuming methods to track your PAN card. You need to call TIN call Centre on 020-27218080 to get your PAN card status. You need to quote your 15 digit acknowledgement number to tarck PAN card. Tracking PAN card status over a phone call is straightforward and can be completed in a few clicks.

Track PAN card status with a SMS

NSDL has provided a facility to track PAN with the help of a SMS too. You can check the status of a lost PAN card or a new PAN card with the help of SMS. You need to make sure that you check PAN card status only after 3 days post submission of your PAN application.

To check PAN card status with SMS by sending a SMS “NSDL <> 15 digit acknowledgement number” to 57575. You would get status on your phone mentioning your current status. If your PAN card is active then you would receive following message “Your PAN is Active and the details are matching with PAN Database”

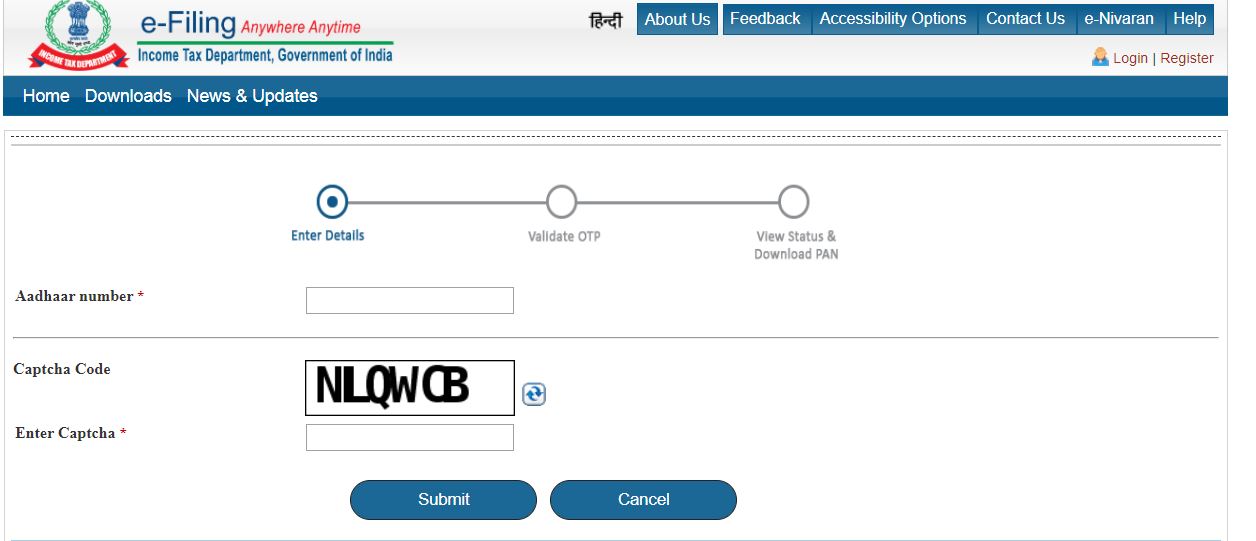

Track PAN card status with Aadhar number

You can check tarck of your PAN card with the help of an aadhar number too. This method of tracking your PAN card is available only for Indian individuals and not available for an entity such as a company or a firm etc.

Let us look on how to track PAN card status with Aadhar number-

Step 1 – Visit official Income Tax filing portal

Step 2 – Enter your 12 digit Aadhaar number and Captcha code

Step 3 – Now, you need to click on submit button

Step 4 – You will need to complete your Aadhar OTP and post verification, your status would be displayed on screen.

Conclusion

In this post we have discussed various methods to track a PAN card. Apart from tracking your PAN card on NSDL portal and on UTIITSL portal with acknowledgement number, you can also track status for a PAN card with Aadhar, SMS, call and date of birth.

Some of these methods are applicable for checking your own or your client’s status. PAN number is one of the most important identity numbers that is granted for an individual and utilized in filing an ITR. You can check our detailed post on PAN card here. We will continue to write more informative articles on PAN cards in the future too.