Non resident taxable person under GST law FAQs

Continuing with our series on FAQs related to GST registration . Let us discuss some important FAQs on Non resident taxable person under GST. It is very important to know important details of Non resident taxable person under GST. Let us try to answer maximum question related to same topic as we can in this article on GST registration-

Q – Who is a Non resident taxable person under GST?

Q – Who is a Non resident taxable person under GST?

A – Non-Resident Taxable Persons are those foreign Taxpayers who visit India for Business for a very

short time. They do not have any permanent place of business in India. For example, foreign

entities participating in Trade Fairs, exhibitions, etc.

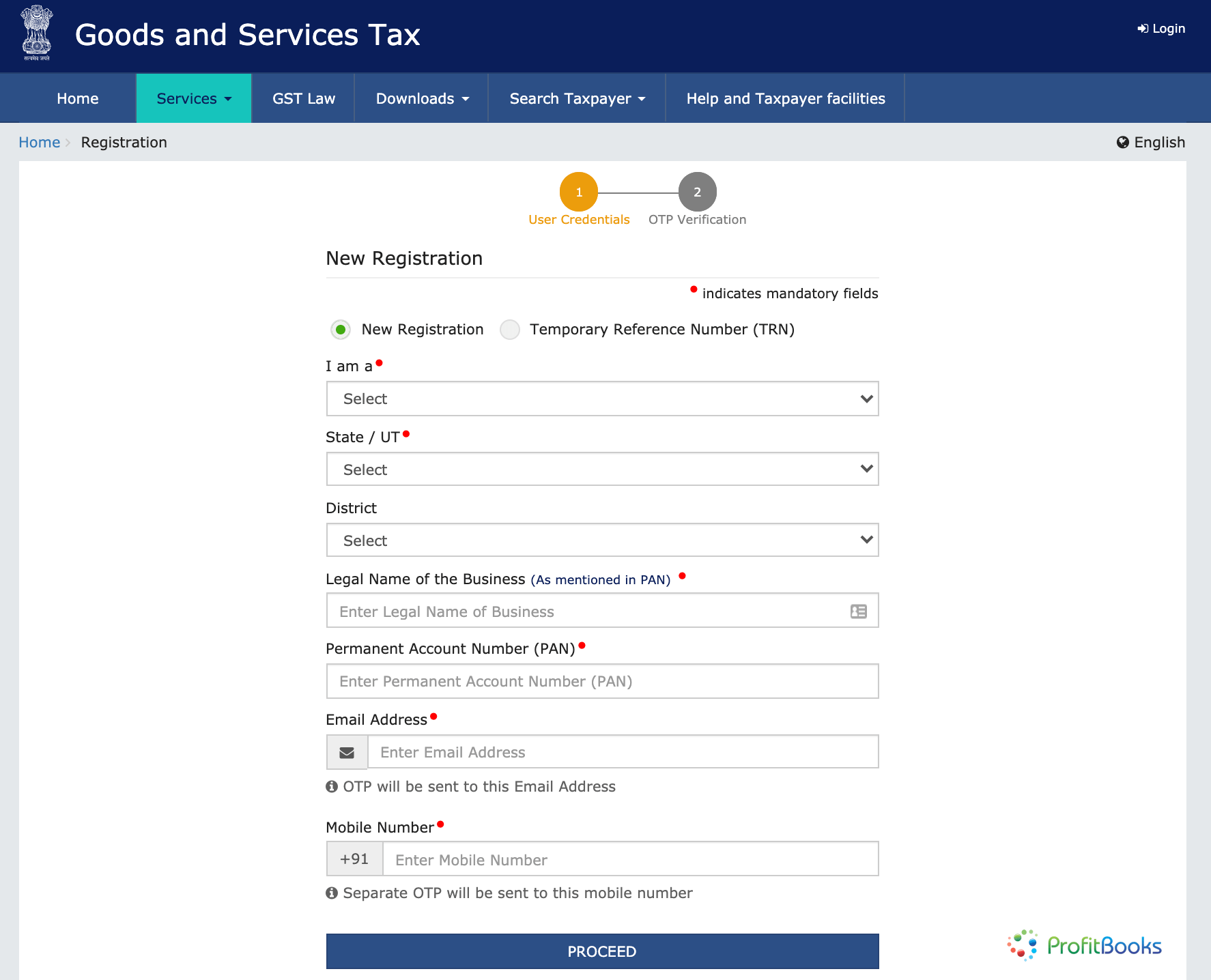

Q – How can i obtain GST registration if i am a Non resident taxable person under GST?

A – It is very easy to register for the same as process is online and seamless. Applicant would need to apply on GST portal. You can apply without prior enrollment. You need to to upload scanned copies of required documents. Once a complete application is submitted online acknowledgement Number would be generated and intimated to the applicant.

Q – What would happen after i submit my application on GST portal?

A – Your application would be passed to state tax authority. State tax authority would pass your application to a jurisdiction officer who would examine your application within 3 working days. Once the application is approved, a GSTIN would be generated and would be sent to applicant along with password. However, approval for GST Registration and GST registration certificate would be provided by state tax authorities.

Q – Would i be intimated if my registration is cancelled?

A – Yes

Q – Would PAN be needed for registration under Non resident taxable person under GST?

A – No, You would not a PAN to obtain the same.

Q – Would i require a authorized signatory for the same?

A – Yes, you must have an authorized signatory who is an Indian citizen with a valid PAN card.

Q – Do I need an Indian mobile number to obtain a temporary registration as a Non Resident Taxable Person?

Q – Do I need an Indian mobile number to obtain a temporary registration as a Non Resident Taxable Person?

A – No, you do not need an Indian mobile number to obtain a temporary registration as a Non Resident Taxable Person however, you must have an authorized signatory who is an Indian citizen with a valid Indian mobile number.

Q – Is a place of business is required for registration?

A – Yes, It is mandatory that you acquire a place of business before you apply for registration under Non resident taxable person under GST.

Q – By when should I apply for a Registration for the same?

A – You should apply for the same at least 5 days prior to date of commencement of business.

Q – For how many days, is this registration valid?

A – Registration for the same can be granted for maximum of 90 days.

Q – Can I extend my Registration as a Non-Resident Taxable Person?

A – Yes, you can extend your Registration for the same once for an additional period of 90 days if you apply before the expiration of the initial period.

Q – Why I am asked to fill a GST challan the moment i select registration as non resident taxable person?

A – In case of Registration as a Non-Resident Taxable Person, you are required by law to deposit the tax in advance based on the estimated turnover for the period for which the registration has been obtained.

Q – Is GSTIN provided provisional?

A – Yes, The status of this GSTIN will be provisional until your application is approved by the tax authority and the registration is officially granted.

Q – Is there any fixed amount that i need to deposit before registering ?

A – No, You are not required to pay any fixed amount prior to registration. However, You are required to pay tax in advance based on the estimated turnover.

In this article, we have discussed FAQs related to Non taxable person under GST. We would be adding more articles in future too. Meanwhile to read articles related to GST Non core field amendment, you can click here or visit us here to read exhaustive articles related to GST registration.

Cool website!

My name’s Eric, and I just found your site – varuntripathi.com – while surfing the net. You showed up at the top of the search results, so I checked you out. Looks like what you’re doing is pretty cool.

But if you don’t mind me asking – after someone like me stumbles across varuntripathi.com, what usually happens?

Is your site generating leads for your business?

I’m guessing some, but I also bet you’d like more… studies show that 7 out 10 who land on a site wind up leaving without a trace.

Not good.

Here’s a thought – what if there was an easy way for every visitor to “raise their hand” to get a phone call from you INSTANTLY… the second they hit your site and said, “call me now.”

You can –

Talk With Web Visitor is a software widget that’s works on your site, ready to capture any visitor’s Name, Email address and Phone Number. It lets you know IMMEDIATELY – so that you can talk to that lead while they’re literally looking over your site.

CLICK HERE http://www.talkwithwebvisitors.com to try out a Live Demo with Talk With Web Visitor now to see exactly how it works.

Time is money when it comes to connecting with leads – the difference between contacting someone within 5 minutes versus 30 minutes later can be huge – like 100 times better!

That’s why we built out our new SMS Text With Lead feature… because once you’ve captured the visitor’s phone number, you can automatically start a text message (SMS) conversation.

Think about the possibilities – even if you don’t close a deal then and there, you can follow up with text messages for new offers, content links, even just “how you doing?” notes to build a relationship.

Wouldn’t that be cool?

CLICK HERE http://www.talkwithwebvisitors.com to discover what Talk With Web Visitor can do for your business.

You could be converting up to 100X more leads today!

Eric

PS: Talk With Web Visitor offers a FREE 14 days trial – and it even includes International Long Distance Calling.

You have customers waiting to talk with you right now… don’t keep them waiting.

CLICK HERE http://www.talkwithwebvisitors.com to try Talk With Web Visitor now.

If you’d like to unsubscribe click here http://talkwithwebvisitors.com/unsubscribe.aspx?d=varuntripathi.com