GST HSN and SAC code FAQs

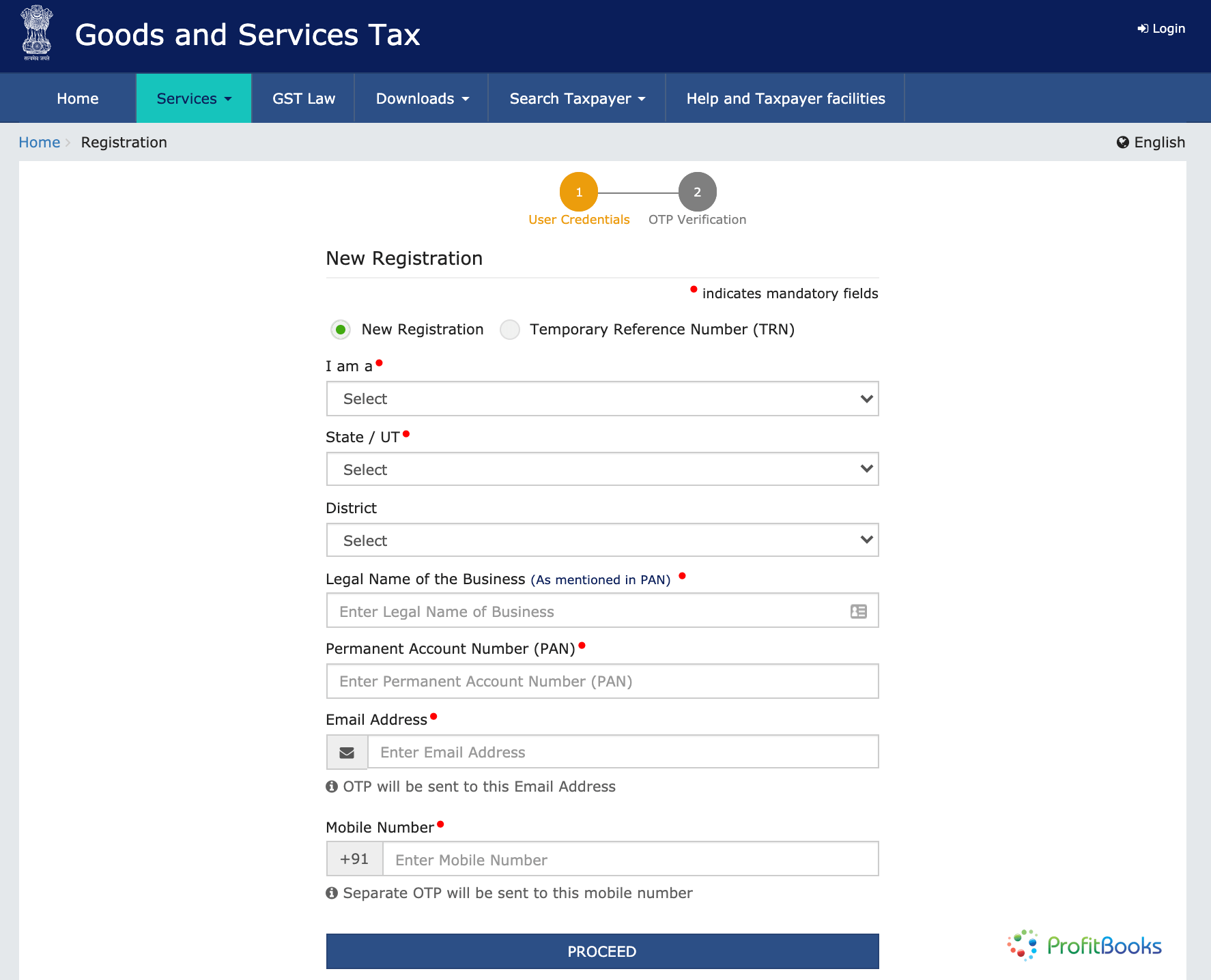

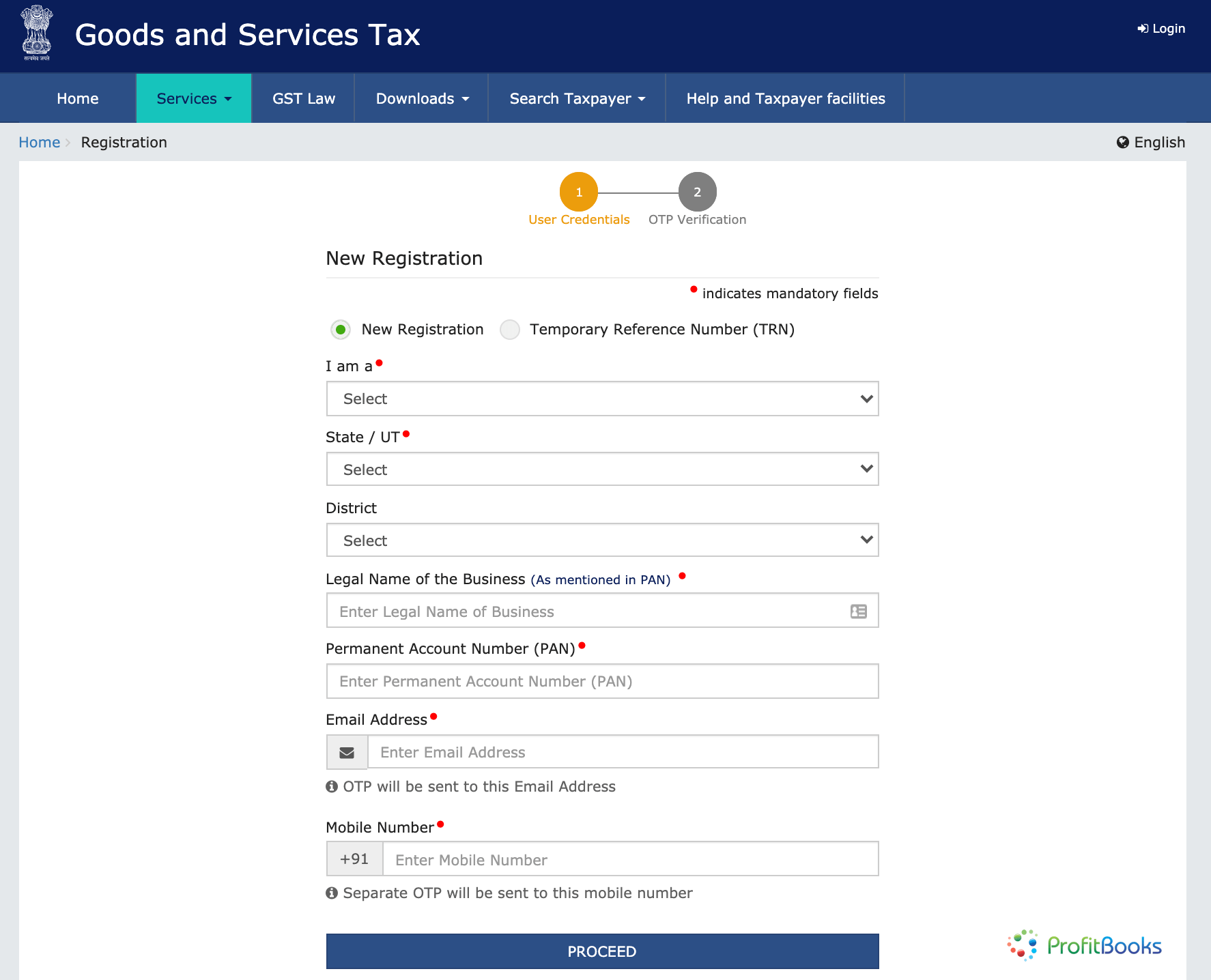

Continuing with our series on FAQs related to GST registration series. Let us discuss some important FAQs on GST Goods and Services. It is very important to be clear about points related to GST Goods and Services during fresh GST registration application. Let us try to answer maximum question related to same topic as we can in this article on GST registration-

Q – Is it mandatory to provide HSN/SAC Codes during fresh GST registration?

A – You are required to provide a minimum of just one goods or service (one HSN code or SAC code) during fresh GST registration.

Q – I supply multiple goods and/or services but the form is only asking me to specify the top 5

goods and top 5 services. Does this mean I can only supply 5 goods and 5 services?

A – No, there is no limit to the number of goods you can supply or the number of services you can provide under a single registration. Since it will be mandatory to enter HSN/SAC details in the line items in invoices under the GST regime, the HSN/SAC information will be readily available to the relevant stakeholders.

Q – Do I need to take an additional GST registration if I want to supply more than 5 goods and/or services?

A – No, you need not take an additional GST registration if you want to supply more than 5 goods and/or services.

Q – I don’t know the HSN Code for any of the products I supply. What do I do?

A – The Goods and Services section of the new registration application form has a built-in online utility

that will help you select the HSN Code. For the Goods section, simply start typing the type of product under Search HSN Chapter by Name or Code and there will be a dropdown from which you can select the relevant chapter. Once you have selected the chapter, start typing in the Search the HSN Code field and select the type of product. The HSN Code of the goods will be auto populated in the application. You can repeat the same if you want to enter details for more than one item.

Q – How do I search for SAC Codes?

A – The Goods and Services section of the new GST registration application form has a built-in online utility that will help you select the SAC code. For the Services section, simply start typing the type of service and there will be a dropdown from which you can select the relevant service. Once you have selected the service, the SAC Code of the service will be auto populated in the application. You can repeat the same if you want to enter details for more than one service.

Q – I am entering the name of the goods/service but the system is unable to find it during GST registration?

A – Please make sure you type slowly. If the online utility can’t find the goods/service, simply move on to the next section if you have added at least one goods/service since there are more than 17000 codes and it may be difficult for you to find the exact code on your own. If you supply only one goods, please contact a tax professional or your jurisdictional officer. If you provide a single service, you can refer to the CBEC website here.

In this article, we have discussed FAQs related to HSN code and SAC code in GST. We would be adding more articles in future too. Meanwhile to read articles related to GST additional place of business and GST bank account, you can click here or visit us here to read exhaustive articles related to GST registration.

1 Response

[…] GST registration Goods and Services FAQs […]