GST Non core field amendment in GST registration FAQs

Non core field amendment during GST registration

Continuing with our series on FAQs related to GST registration . Let us discuss some important FAQs on How to do GST non core field amendment. GST non core field amendment during fresh GST registration application is very simple process. Let us try to answer maximum question related to same topic as we can in this article on GST registration-

Q – What do you mean by GST non core field amendment?

Q – What do you mean by GST non core field amendment?

A – GST non core field amendment stands for amending fields part from fields mentioned below in GST registration application form-

- Name of business

- Principal place of business

- additional place of business

- Addition/deletion of partners or directors, Karta, Managing committee, Board of trustees, Chief executive officer.

- PAN number

Q – Do i need approval from tax officials for changing non core fields in GST registration application form?

A – No, You do not require any permission for changing non core fields in GST application form

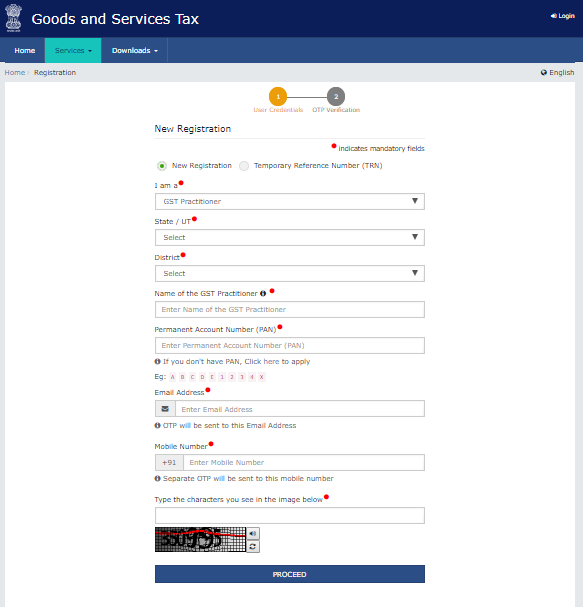

Q – Do i need any permission from tax officials for updating my mobile number or email address?

A – No, you do not need any approval for this. In fact, you can change it by yourself by doing a login on GST portal and performing required changes yourself.

Q – Are there any non editable fields which i cannot edit?

Q – Are there any non editable fields which i cannot edit?

A – Yes, there are non editable fields on GST registration which are auto filled and you would not be able to edit those. These core fields on GST application are –

- Name of Business

- Principal Place of Business

- Additional Places of Business

- Addition/ Deletion of Partners or Directors, Karta, Managing Committee, Board of

Trustees, Chief Executive Officer or equivalent, responsible for day to day affairs of the

business

Q – Do i need to file “Application for amendment” to change non core fields in GST application?

A – Yes, you need to file “Application for amendment” to perform amendment to your applications’ non core fields.

Q – Can i save GST non core field amendment application and for how long?

A – Yes, you can save your GST amendment application for a maximum of 15 days before submitting it on the GST Portal after which it will be automatically purged by the system.

Q – Do I need to digitally sign the Amendment Application before submitting it on the GST Website?

A – Yes, you need to digitally sign your amendment application just like you have done for your registration application.

In this article, we have discussed FAQs related to GST non core field amendment. We would be adding more articles in future too. Meanwhile to read articles related to GST core field amendment, you can click here or visit us here to read exhaustive articles related to GST registration.

1 Response

[…] GST Non core field amendment in GST registration FAQs […]