Kotak Mahindra Business Loan

Kotak Mahindra Business Loan

Kotak Mahindra Bank is one of the largest private sector banks in india. It offers variety of loan offers to its customers and general public. In this article, we would look into various features of Kotak Mahindra Business Loan. Let us look at the various features of Business loan here-

Business Loan Amount – Kotak offers business loan from Rs 3 Lakhs to Rs 75 Lakhs to all the eligible business people. Business loan amount is decided on the basis of credit worthiness of the business and businessman. Kotak business loans are unsecured business loan which means that you would not be required to offer any collateral for your loan.

Loan Tenure – Kotak offers business loan up to 48 months. Loans from Kotak are processed in a relatively faster pace compared to public sector banks such as SBI, PNB and others

Loan eligibility – Basic eligibility criteria for a loan from Kotak Mahindra Bank are mentioned below-

- Business has to have a vintage of at least 3 years with minimum turnover of 40 lakhs in past one year

- Business should be profitable in at least one of the past 3 years taken for business vintage

- The applicant should be a Sole Proprietor / Partnership firm / Private Ltd Co. / Trust / LLP involved in the business of Manufacturing, Trading or Services

- Applicant’s age should be between 25 years and 65 years

Loan fee and charges – Processing fee is 2% of total loan amount. Documentation charges varies between 3500 to 6500 for depending on loan amount.

Business Loan documents

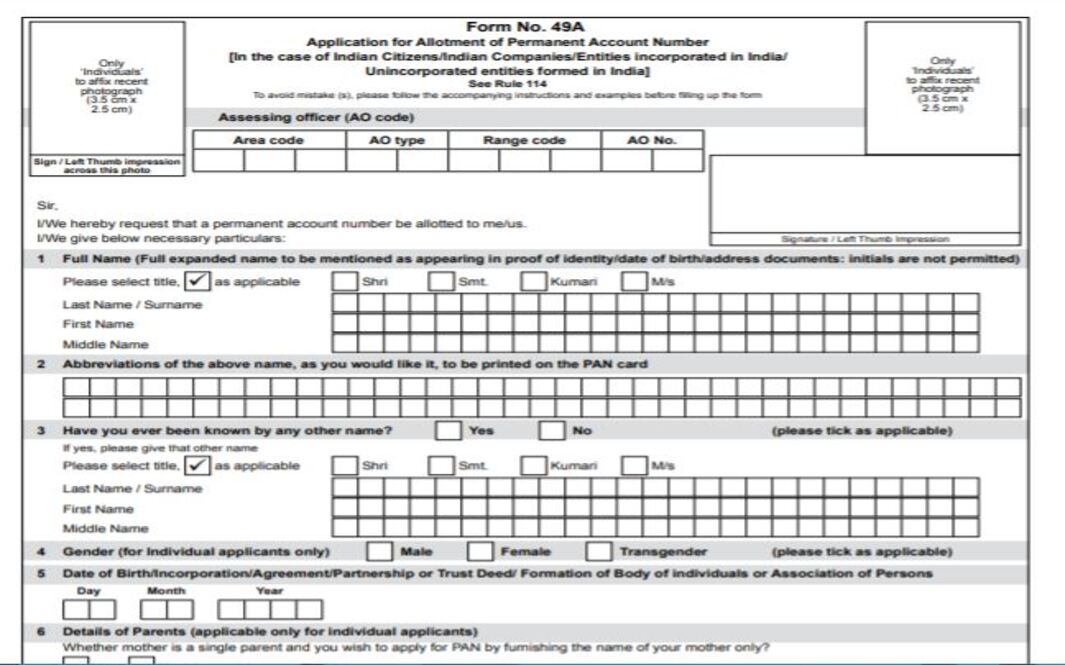

| Identity proof | PAN Card/Driving License/ Passport/ Voter’s ID/ Aadhaar Card |

| Ownership proof | Agreement Copy / Electricity Bill / Maintenance Bill with share certificate / Municipal tax bill/Share certificate |

| Firm Constitution | MOA/Partner Ship Deed/GST Registration Certificate |

| Banking | Last six months bank statement (Business Accounts) |

| Address Proof | Passport/Driving License/Voter’s ID/Aadhaar Card/Utility Bill/Bank Statement/Bank Account Passbook (Updated and no more than 3 months old) |

| Business continuity proof | Shop and Establishment certificate/Tax registrations-VAT/Service tax/GST registrations |

| Financial | 1.Latest two years financials of the firm with turnover of gretaer than Rs 2 Crores |

| Tax | 2.Latest Tax Audit Report. |

Business Loan EMI – Kotak business loan EMI depends upon 3 factors viz Loan amount required, Loan tenure, rate of interest etc. You can use following business loan emi calculator for calculate your EMI.

If you want to read more about business loans offered by other major banks then you can visit following articles.

- SBI Business Loan

- HDFC Business Loan for traders

- ICICI Business Loan

- Axis Business Loan

- Axis Mudra Loans

- PNB Business Loan