SBI Home Loan Top up

SBI Home Loan Top up

Table of Contents

SBI is the largest bank in India in terms of deposits and advances. State Bank of India offers all the types and varieties of Home Loan to its customers in India as well as abroad. SBI Home Loan Top up is a unique product from SBI that is offered to existing Home Loan customers of State Bank of India . In this post, we would look into various features of a To up Loan from SBI.

SBI Home Top up Loan

One of the most important features of a State Bank of India Top up loan is that it comes with a lower rate of interest compared to other banks. Other important features of a top up loan from SBI includes-

- Very low processing fees

- No hidden charges and no foreclosure charges for Top up customers

- A larger tenure of 30 years can be availed for this loan

- In this loan, interest is charged on the reducing balance and it is also available as an overdraft facility

Eligibility for State Bank of India Top up Loan

- Both Indian as well as NRI are eligible for a top up loan from SBI

- An applicant should be older than 18 years and younger than 70 years at the time loan maturity

- Top up loan can be availed for a period of 30 years

Interest rates on State Bank of India Home Top up Loan

| Top Up Loan | ||

| CIBIL Score | Term Loan | OverDraft |

| >=800 | 6.95% | 7.35% |

| 750-799 | 7.05% | 7.45% |

| 700-749 | 7.15% | 7.55% |

| 650-699 | 7.25% | 7.65% |

| 550-649 | 7.65% | 7.95% |

| NTC/No Cibil Score | – | – |

For updated list of Interest rates for SBI Home Loan you can visit this link

Documents required for Home Top up Loan

SBI Home Loan Top up mandatory Documents

- Employer Identity card

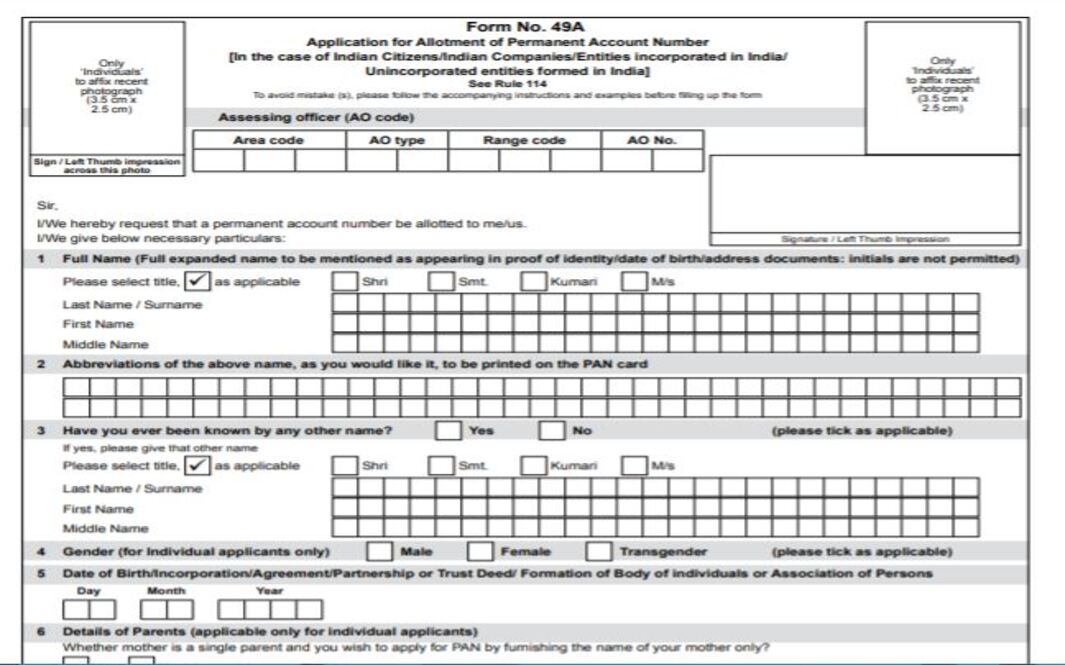

- Complete Loan application form along with 3 passport sized affixed photographs

- Proof of identity such as PAN card, Voter ID

- Proof of residence

Property papers

- Permission for construction

- Agreement for sale

- Occupancy certificate if property is ready to move

- Approved plan copy, Conveyance deed

- Payment receipts towards builder

Account Statement and Income proof

- Last 6 months Bank account statement for all bank account hold by owner

- Previous Loan account statement of all previous loan accounts

- Last 3 months salary slips and salary certificates

- Copy of form 16 for last 2 years and last 2 years Income tax returns acknowledged by income tax department

- Business address proof

- Income tax returns for past 3 years

- Balance Sheet and income statement for past 3 years

- TDS Certificate

- Qualification certificate

SBI Smart Home Top up Loan

SBI smart top up loan is a unique product offered by Bank for its existing Home Loan customers in which a top up amount is offered to its customers to be utilized for personal use such as Wedding, purchase of a appliances, medical expenses etc.

Key features of SBI Smart Home Top up Loan are-

- Loan tenure up to 20 years

- CIBIL score of 550 or more is required

- Loan amount up to 5 Lakhs can be provided under this loan

- Satisfactory loan repayment track record of at least 1 year should be available at the time loan sanction with no DPD in credit bureau report

- No other documentation is required to avail Smart Top up Loan

In this post, we have discussed various features of SBI Top up Home Loan offered by SBI to its customers. These top up loans are perfect to avail a short term credit facility to meet immediate requirements such as wedding, medical expenses, fee payment and other personal expenses. You can read our other articles on Home Loan from below-

- State Bank of India Regular Home Loan

- State Bank of India Home Loan interest rates

- State Bank of India Home Loan EMI Calculator

- State Bank of India MaxGain Home Loan