SBI EMI Car Loan Calculator

SBI EMI Car Loan Calculator

Table of Contents

SBI is the largest bank in India both in terms of market deposits as well as advances. State Bank of India is the first choice bank for most of the individuals who want to avail a car loan for purchase of their dream car. SBI offers car loan at attractive rate of interest and funds close to 80%-90% of vehicle on road price. SBI EMI Car Loan Calculator is a simple utility that helps in calculating EMI for a car loan for a specific loan amount and rate of interest.

Eligibility norms for SBI Car loan are pretty relaxed and one can avail a car loan if he or she is having a valid income proof and is meeting eligibility criteria of the bank. With branches located all across India, getting a car loan from a bank like SBI is one of the easiest process for a new applicant.

Usefulness of a SBI EMI Car Loan Calculator

SBI Car loan calculator is useful in many ways but let us look at most important utilities provided by this calculator-

- SBI EMI Car Loan Calculator can help an applicant or a prospective buyer to select a loan scheme that is most suitable to his or her needs

- An applicant can mix or match his loan amount depending upon rate of interest and tenure chosen

- SBI EMI Car Loan Calculator helps is foreclosure of a loan as one can immediately view his pending EMI for a car loan

- EMI Calculator also displays results on the go and helps in quick decision making for a prospective car buyer

SBI Car Loan calculator workings

Let us take a look how a car loan calculator actually works. There are basically two types of car loan emi calculators, one is a basic excel and other can be used from online website of a bank.

Car Loan calculator in Microsoft Excel

You can easily calculate your business loan EMI with the help of Microsoft Excel program. For calculation your loan EMI, you would be required to use PMT function in Excel. Working of PMT function is shown below –

| Rate | 1% |

| Nper | 60 |

| PV | 1000000 |

| EMI | ₹ 21,247.04 |

In above example, Excel based Business loan EMI calculator has calculated EMI for a Rs 10 lakhs loan at the rate of 10% per annum for 60 months. Care should be taken to take uniform numbers while inputting formula. For example, if duration chosen is in months then rate of interest should also be inputted in months. To use calculator in Excel, you should be able to use Microsoft Excel and be comfortable in using functions that are provided by Microsoft Excel.

Car Loan EMI calculator foundation

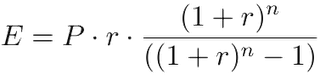

where

E is EMI

P is Principal Loan Amount

r is rate of interest calculated on monthly basis. (i.e., r = Rate of Annual interest/12/100. If rate of interest is 10.5% per annum, then r = 10.5/12/100=0.00875)

n is loan term / tenure / duration in number of months

In most of the business loan products in the market, interest is usually charged on the reducing balance. Due to this reason, interest component of the EMI would gradually increase with time and principal would similarly reduce.

In this article, we have seen working and foundation for an EMI calculator used by industry. If you want to read more about SBI loan, you can visit our detailed articles on SBI loan here.

SBI Car Loan EMI/Amortization schedule

An Amortization or EMI schedule is a schedule for payments that is to paid by a SBI car loan holder at a regular interval of time usually a month. Key features of an amortization schedule includes your car laon emi. emi number, principal and interest components etc. An amortization schedule is provide at the start of a relationship between a bank and a customer.

In this post, we have look into details of SBI EMI Car Loan Calculator and usefulness of it, If you want to read more about other EMI calculators such as SBI EMI Home Loan Calculator, then you can visit this link