ICICI Bank personal Loan

ICICI Bank personal loan

Table of Contents

ICICI Bank is one of the largest private sector banks in India. ICICI Bank is one of the pioneers in technological innovation in its banking services offered to customers. ICICI bank offers personal loan to applicants in a complete digital manner with very low paperwork involved. ICICI Banks is known for its fast and transparent loan approval process. In this article, we would looking into various features of a ICICI Bank personal loan.

Let us look at the various key features of a personal loan from ICICI Bank-

- Interest rates offered on this loans start from 9.5% onwards and is one of the lowest rates offered for a personal loan in India

- Eligible individuals can get a loan amount up to 25 Lakhs from ICICI Bank. However, minimum loan amount offered is Rs 50 thousand

- ICICI Bank offers flexible loan tenure options to its customers ranging form 12 months to 72 months

- ICICI Bank asks for a no collateral for its personal loan. You would not be required to submit any property papers with ICICI Bank to avail this loan

- ICICI Bank offers a total digital process from loan login to loan disbursal. Applicant doesn’t need to upload any paper documents and moreover agreement signing is also digital

- Quick loan disbursal is offered to applicant and one can expect disbursal in account within 6 hours of completion of whole loan process

- Eligible existing customers can also avail benefit of pre approved offers form ICICI Bank. Under pre approved offers, ICICI Bank offers personal loan to selected customers at a lower interest rates and higher loan amount.

- ICICI Bank doesn’t ask for a end use of personal loan and users are free to use ICICI Bank loan for any use he or she may find suitable

ICICI Bank personal loan interest rates

| Interest Rate | 10.50% -19.00%p.a. |

| For NRIs | 15.49% p.a. onwards |

| Flexicash (Overdraft facility to salary account holders) | 12%-14% p.a. |

ICICI Bank personal loan eligibility

For a salaried person, eligibility criteria is as follows-

- Age of applicant should be between 23 years and 58 years

- Net salary of minimum 30 thousand per month credited in bank account

- Total years in job should be at least 2 years

- Years in current residence address should be at least 1 year

For self employed individual, eligibility criteria is as follows-

- Age should be between 28 years and 65 years. However, for doctors age is relaxed to minimum 25 years.

- Minimum turnover should be at least 40 lakhs for non professionals and for professionals such as doctors, CAs minimum turnover should be 15 lakhs in audited financials

- Minimum net profit should be at least 2 Lakhs in audited financials

- Minimum business stability at current business should be at least 5 years and it is relaxed to 3 years for doctors

ICICI Bank personal loan fee and charges

- Loan processing fee and Loan origination charges at 2.5% of loan amount plus GST

- Prepayment charges of 5% of principal outstanding along with GST

- Late interest charges of 24% per annum

- EMI bounce charges of 400 plus GST

- Auto debit bounce charges of 50 plus GST

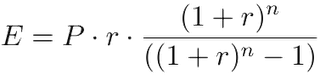

ICICI Bank personal loan EMI Calculator

You can calculate your personal loan EMI by using a EMI Loan calculator available online.

Business Loan EMI calculator foundation

where

E is EMI

P is Principal Loan Amount

r is rate of interest calculated on monthly basis. (i.e., r = Rate of Annual interest/12/100. If rate of interest is 10.5% per annum, then r = 10.5/12/100=0.00875)

n is loan term / tenure / duration in number of months

Personal Loan Documents

| For Salaried | |

| Proof of Identity | Passport / Driving License / Voters ID / PAN Card (any one) |

| Proof of Address | Passport / Driving License / Voter ID / Utility Bill |

| Latest 3 months bank statement | |

| Salary slip of last 3 months | |

| 2 passport size photographs | |

| For Self Employed | |

| Proof of Identity | Passport / Driving License / Voters ID / PAN Card (any one) |

| Proof of Address | Passport / Driving License / Voter ID / Utility Bill |

| Income Proof | Audited financials of last 2 years |

| Bank Statement | Latest 6 months Bank statement |

| Office address proof, Business registration proof | |

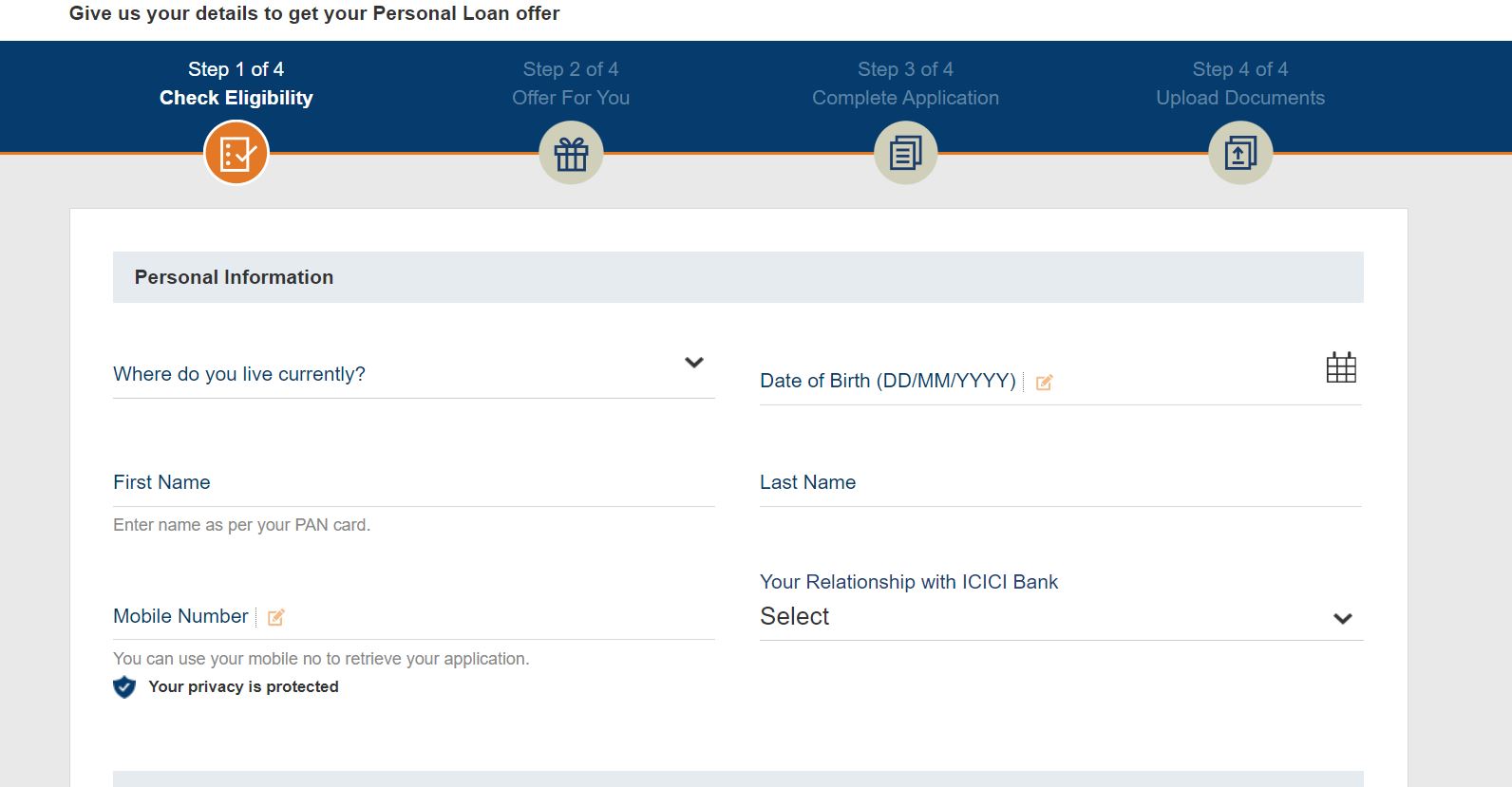

Personal Loan Application form

You can complete application for a personal loan from here. You need to enter basic details such as your name, address, name of employer, PAN and other ID details. Post completion of application form, you would get a pre approved offer from ICICI Bank. If you like the offer then you need to submit relevant documents and accept the terms and conditions for the loan. Post acceptance, Loan amount would be disbursed in your account after deducting charges like processing fees etc.

If you want to read more about business loans offered by other major banks then you can visit following articles.

- SBI Business Loan

- HDFC Business Loan for traders

- ICICI Business Loan

- Axis Business Loan

- Axis Mudra Loans

- PNB Business Loan

- Kotak Mahindra Business Loan

- Yes Business Loan

- Bank of Baroda Business Loan