Home Loan EMI Calculator

Home Loan is one of the most popular scheme for a potential borrower who wants to purchase a home for himself. Home Loan is offered by most of the banks and NBFCs in India for potential borrowers. Documents required for a Home Loan are pretty basic in nature and can be accessed from here.

Home Loan interest rates have recently increased post rate increase by central bank. Howver, still Home loan interest rates are relatively chepaer compared to earlier home loan rates. You can gather latest interest rates for Home loan for two of the most popular banks from these links – HDFC Home Loan interest rates and SBI Home Loan interest rates

Home Loan EMI Calculator

Home loan is a loan that is secured in nature and is offered in the form of a term loan with repayments divided into equated monthly installments or EMI. An Home Loan EMI Calculator is an easy to use utility that enables individual applicant to calculates its Home loan emi for a specific tenure. In this article, we would look into detail of working of an EMI calculator

Components of an EMI

An EMI consists of two components mainly principal and interest. Interest is the amount simple interest that a bank would charge on a closing principal on the date. With time, your principal component would reduce and thus interest charged on that principal would also reduce. One benefit of an EMI is that at the end of tenure. principal would always reduce to zero and EMI also provide a facility of repaying your loan in a structured manner with timely deduction of EMI from bank accounts.

Let us look at the workings of a business loan EMI calculator. AN EMI calculator is an easy utility that can be used to calculate an EMI for your loan

Home Loan EMI calculator on Excel

You can easily calculate your Home loan EMI with the help of Microsoft Excel program. For calculation your loan EMI, you would be required to use PMT function in Excel. Working of PMT function is shown below –

| Rate | 1% |

| Nper | 60 |

| PV | 1000000 |

| EMI | ₹ 21,247.04 |

In above example, Excel based Home loan EMI calculator has calculated EMI for a Rs 10 lakhs loan at the rate of 10% per annum for 60 months. Care should be taken to take uniform numbers while inputting formula. For example, if duration chosen is in months then rate of interest should also be inputted in months.

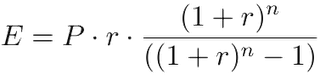

Business Loan EMI calculator foundation

where

E is EMI

P is Principal Loan Amount

r is rate of interest calculated on monthly basis. (i.e., r = Rate of Annual interest/12/100. If rate of interest is 10.5% per annum, then r = 10.5/12/100=0.00875)

n is loan term / tenure / duration in number of months

In most of the Home loan products in the market, interest is usually charged on the reducing balance. Due to this reason, interest component of the EMI would gradually increase with time and principal would similarly reduce.

In this article, we have seen working and foundation for an EMI calculator used by industry. If you want to read more about Home loan, you can visit our detailed articles on Home loan here.