HDFC Home Loan

HDFC is one of the pioneers when it comes to Home Loan disbursement in India. HDFC is specialized

HDFC is one of the pioneers when it comes to Home Loan disbursement in India. HDFC is specialized

A trademark is a intellectual property consisting of recognizable sign, expression or design which identifies particular product or services from other. A trademark can be owned by a individual, business organization or legal entity. A trademark can be located on package label or organization. Trademark is an intellectual property that is used to differentiate products and services of one firm or individual from others. Trademark search is one of the most crucial steps before registering a trademark for your product or services.

For an entrepreneur, it is very important to find a brand for their product or services. You want to have a unique brand name for your product and service but, most of the time it is already taken. It is quite imperative to perform a trademark search for your brand name initially. A trademark is an unique identifier for a product or a firm. Owner of a trademark can pursue legal action for infringement of trademark.

Trademark protects your unique brand name from infringement and copying by other business. Trademark public search is a method to search for publicly available trademarks in case you are also protected from a future legal repercussion for using someone else’s brand name.

A tm search would protect you from future legal tangles if you by mistake use someone else’s brand name. A business take many year of hard work to develop and a brand name has its own life. A company or product is usually remembered by its brand name. Brand name has its own intangible values in the mind of a consumer and every organization should make sure that trademark name chosen should be free of any future charges against it as it can diminish or eradicate value in a matter of few days.

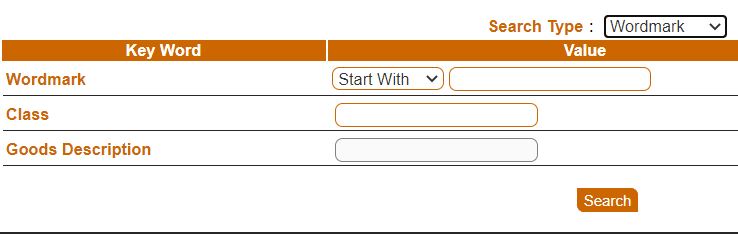

TM Search can be performed on official trademark registry available online. Any trademark which ever has been filed or registered online is available on given registry. The ipindiaonline interface allows three types of tm search on its portal. Trademark public search portal can be accessed on ipindia public search official webiste.

Three types of tm search available on trademark public search are –

Workmark search

The wordmark search allows for retrieving trademarks which use the same word as that of the query entered. The trademark office website allows for a search query with three options:

In this article, we are going to discuss various FAQs related to pollution NOC certificate. Getting an pollution NOC is a mandatory step before starting any industry within India. Environment is one of the most important topic in 21st century. It is imperative for industry to make sure that they are not disturbing environmental balance. This NOC certificate is issued by state pollution control board such as MPCB, DPCC, RPCB etc.

State pollution board work in conjunction with central pollution control authority to maintain sanctity of environmental laws within country. India has one of the most exhaustive laws on environmental protection. Pollution NOC is provided in the form of consent by pollution control boards. Let us look at some important FAQs related for the same-

A – The Central pollution control board or CBCB is an statutory organization that comes under Ministry of environment, forest and climate change.

A – Central pollution control board was established in 1974. CPCB head quarter in Delhi and acts as an apex body for pollution control in India. CPCB has 7 zonal offices and 5 laboratories.

A – Central functions of CPCB includes –

A – There are two types of NOCs required in India. They are consent to operate and consent to establish.

A – It is a initial permission required from state pollution control authority for starting a business. Consent to establish is provided keeping in mind various aspects related to pollution control enlisted in law.

A – It is the second level of consent required by a business operating India. This consent is require to be obtained any level of pollution spread by the business.

A – The CPCB has categorized various industries on 4 categories – Red, Green, Orange and White.

A – Yes, one need to fill an application for obtaining a consent from state pollution control authority. Every SPCB have their own application form.

A – Application for NOC from state pollution board must contain information such as proposed pollution control plans, site details, and other registration certificates from the Industry Department, etc.

A – State pollution control board need to reply within 4 months of receiving application for NOC.

A – Documents required for NOC would include Location plan, registration documents of firm , Ownership of land, detailed project report, compliance report etc. For full list of documents required for NOC, you can visit documents required to obtain a pollution NOC certificate from pollution control board

A – Please check documents required for water consent from state pollution control board

A – Applicant need to apply on state pollution control website along with application form and required documents. Once, application is submitted to the authorities. They would inspect premise to verify details mentioned in application form. Documents submitted would be vetted for genuineness and eligibility. If applicant is found eligible for NOC the, state pollution board would issue a consent against his name.

A – You can get pollution control certificate in Tamil Nadu from Tamil Nadu pollution control board website.

A – Gujarat pollution control board or GPCB is a regulatory body in Gujarat for prevention of pollution within Gujarat. To get a pollution control certificate, one need to apply with GPCB with relevant documents as mentioned earlier.

A – To get an MPCB certificate, applicant can register on MPCB portal. On portal, application form for pollution certificate need to be filled along with documents. MPCB officers will appraise the application and issue a certificate if found to be successful.

A – To get an Odisha pollution certificate, applicant can register on ODOCMMS portal. On portal, application form for pollution certificate need to be filled along with documents. ODOCMMS officers will appraise the application and issue a certificate if found to be successful.

A – To get an Andhra Pradesh pollution control board ( APPCB) certificate, applicant can register on APPCB Portal. On portal, application form for pollution certificate need to be filled along with documents. APPCB officers will appraise the application and issue a certificate if found to be successful.

A – To get Arunachal Pradesh pollution certificate, you need to apply with regulatory authority in Arunachal Pradesh.

ESI stands for Employees’ State Insurance Corporation. It is a self financing social security and health insurance scheme for Indian workers. ESIC is managed by employee state insurance corporation. It functions according to according to rules and regulations stipulated in ESI act, 1948. ESIC is a autonomous body and comes under Ministry of Labor and Employment. ESIC can be accessed at ESIC portal. In this article, we would discuss various benefits associated with ESIC registration. ESIC registration acan be done online on ESIC portal. To find out more about various aspect related to ESIC registration such as ESIC registration eligibility, ESIC respiration steps on ESIC portal and ESIC registration documents required. You can read our article on ESIC registration.

In this article, we have discussed various benefits designed for a ESIC registered employee by ESIC. These benefits are paid by central pool or funds collected by ESIC from ESIC employee contribution and ESIC employer contribution. For further reading on different types of trade licenses required in India, you can visit our website’s other section.

FSSAI stands for Food Safety and Standards Authority of India. FSSAI is an autonomous body established under the the Ministry of Health & Family Welfare, Government of India. It is an autonomous body that monitors and govern food business in India. FSSAI is mainly responsible for protecting and promoting public health through rules and guidelines. FSSAI make sure that FSSAI requirements are taken care by food industry in India.

The FSSAI was established under Food Safety and Standards Act, 2006 (FSS Act). FSSAI guidelines are legal obligations for anyone operating a food business in India. FSSAI rules can be accessed by anyone on FSSAI official site. FSSAI is also responsible for licensing and supervision of Food operators within India. FSSAI and food safety are two side of a same coin. It make sure that under FSSAI regulation, every food operator undergo a quality check for food adulteration and sub standard products.

In this article, we are going to discuss some important FAQs related to FSSAI and FOSCOS FSSAI-

A – FSSAI stands for Food Safety and Standards Authority of India. The FSSAI was established under Food Safety and Standards Act, 2006 (FSS Act). FSSAI guidelines are legal obligations for anyone operating a food business in India.

A – Following statutory power have been given to FSSAI under FSSAI regulation-

A – Yes, every Food business operator or FBO need to register for either FSSAI license or FSSAI registration under FSSAI act 2006.

A – No, FSSAI registrational nd FSSAI license are different.

A – There are three types of FSSAI license and registration. These are –

A – As per official FSSAI requirements and FSSAI rule, FSSAI licensing and registration is done on the basis of turnover and scale of FSSAI approved business. Criteria used for these are-

A – FSSAI license number or FSSAI registration number is a 14 digit number that needs to be printed on all food packages. The registration number provides details about assembling state and and producer’s permit.

A – Yes, you can apply online for FSSAI on FSSAI official website and FOSCOS portal.

A – To get complete FSSAI official documents requirement, kindly visit FSSAI documents required.

A – Various benefits of FSSAI license includes-

A – Central food safety officer is an officer recruited under FSSAI rule. Main responsibility of food safety officer is to make sure that each FBO comply with FSSAI rule.

A – FSSAI technical officer are designated officer who mainly looks into food safety standards.

A – FSSAI approved business has to comply with FSSAI regulation and FSSAI rules. FSSAI food safety officer can conduct the inspection of business anytime. Based on compliance level, food safety officer can issue a improvement notice. FSSAI food safety officer can cancel FSSAI license of FBO given his repeated non compliance.

A – Following are the examples of non compliance as per FSSAI-

Q – What does FOSCOS stands for?

Q – What does FOSCOS stands for?A – FOSCOS stands for Food Safety Compliance System.

A – Yes, FOSCOS has replaced existing FLRS system.

A – FOSCOS has been launched in the states of Tamil Nadu, Puducherry, Gujarat, Goa, Odisha, Manipur, Delhi, Chandigarh and Ladakh.

A – Yes, user can login with existing username and password on FOSCOS portal.

A – Following are the section on FOSCOS FSSAI website–

A – FSSAI registration no or FSSAI license is valid for period up to five years.

A – Yes, You can renew your FSSAI registration.

A – Ideally one should renew FSSAI no at least 120 days before expiry date.

A – Steps are mentioned below-

A – This application is applicable for renewal for FSSAI license and is also known as FSSAI form B

A – The application is applicable for renewal for FSSAI registration is also known as FSSAI form A.

A – FSSAI renewal status can be checked on FSSAI FOSCOS portal or by calling FSSAI helpline no 1800112100

A – You can check FSSAI no online by visiting FSSAI official website.

A – Basic FSSAI registration is processed within 7 days and FSSAI central license as well as FSSAI state license is delivered in 30 days.

Q – How can i check my FSSAI application status?

Q – How can i check my FSSAI application status?A – You can check FSSAI application status online at FSSAI official website or by FSSAI helpline no 1800112100

A – Yes, you should register for a FSSAI registration which is applicable for petty food business operator under FSSAI regulation

A – You should register for FSSAI central license.

A – Food Safety and Standards Authority of India with the help of State Food Authorities are responsible for implementation & enforcement of FSSA, 2006.

A – Following are the objectives of FSSAI-

A – Improvement notice is issued by a Designated Food safety officer to a FBO it fails to comply with official FSSAI rules.

A – Yes, a DO can cancel FSSAI food license if FBO fails to comply with improvement notice after allowing a show cause.

A – Yes, you can modify your FSSAI license.

A – Yes, Any FBO including medical store need to register for FSSAI registration if it is selling dietary supplements.

A – Yes, it comes under FSSAI regulation.

A – Yes

A – You can perform FSSAI online payment by credit or debit card and net banking. FSSAI online payment is required at the time of fresh FSSAI registration or FSSAI license renewal.

A – Yes, you would require a FSSAI central license to import food products from other countries. You would also require IE code.

A – Yes FSSAI license is mandatory even if you trade or distribute food products.

A – Yes catering business require a FSSAI license

A – FSSAI helpline no is 1800112100

A – You can access FSSAI in Hindi on FSSAI official website.

A – No, they are not same. FSSAI company is FSSAI approved business operator while FSSAI is central authority that is designated to govern food business operator and frame FSSAI regulation.

A – Yes, FSSAI is government authorized central body.

A – There are three type of FSSAI license or registration-

Foreign contribution regulation act or FCRA is an act of parliament. It is an mandatory requirement to receive any foreign contribution in India. FCRA regulations are applicable to every registered trust, society, institution or NGOs who wants to receive any foreign grant or fund. Main objective of FCRA rules is to legalize and monitor foreign contribution made in the country.

In this article, We are going to discuss some important FAQs ( Frequently asked questions) on FCRA registration number-

A – FCRA stands for Foreign contribution regulation act. This act was passed by Indian parliament. FCRA registration number is a mandatory requirement. NGO or trust who wants to receive foreign grant need to compulsory register for it under FCRA regulations.

A – Yes, you can apply for FCRA registration number online. You can apply for it on FCRA website.

Q – What are different types of registration under FCRA rules?

Q – What are different types of registration under FCRA rules?A – There are two types of registration for FCRA registration number as per foreign contribution regulation act. These are –

A – Requirements for FCRA registration number application on FCRA website are –

A – Yes, there are entities who are not eligible for FCRA registration number.

A – Under foreign contribution regulation act 2010, FCRA registration certificate is valid for a period of 5 years.

A – Yes, you can renew your FCRA registration number online. You need to visit FCRA website at least 6 months before expiry of FCRA registration number.

A – Yes, authority can can cancel your FCRA registration number. For complete list of reasons for cancellations visit FCRA renewal and suspension.

A – As per foreign contribution regulation act, one can apply for FCRA on FCRA website. Applicant need to completely fill FCRA form along with scanned copies of documents required on FCRA website. For complete guide on FCRA registration, visit FCRA (foreign contribution regulation act) website Registration process.

A – Yes. Under foreign contribution regulation act. It is mandatory to file annual return form FC-4 within 9 months from end of a financial year.

A – There are two methods to apply for FCRA registration number-

For registration, business vintage of at least 3 years is required. Reasonable work needed to be done in the field of public interest in those years. Applicant need to spent at least Rs 10 lakhs in main objectives as per FCRA regulations. For prior permission, applicant need not be registered for a minimum period. Though, applicant need to present approval letter from a foreign contributor for specific activity to get a FCRA registration number.

A – Yes. As per foreign contribution regulation act, individuals like judges, editors, members of legislature, people contesting elections are prohibited from getting a FCRA registration number. For complete list, visit FCRA website.

A – As per foreign contribution regulation act, applicant must be registered under following statute-

A – No, they are not same thing. FEMA is a fiscal legislation under ministry of finance. FCRA is act that mainly governs foreign contribution done to NGO situated within India. Foreign contribution regulation act or FCRA governs all contributions done to Indian NGOs and it is mandatory to register for FCRA registration number to receive foreign grants.

A – Yes, As per Foreign contribution regulation act 2010. Foreign contribution can be received in Indian Rupees.

A- Every organization need to submit form FC-6 as per FCRA regulations. This form along with Income and expenditure statement, balance sheet and Receipt/payment account need to be submitted within 9 months of closure of a financial year.

A – Yes. As per foreign contribution regulation act 2010, each organization who receives more than one crores of a fund in a financial year need to put that data in public domain like website.

A – No, Fund received from a NRI through normal banking channels in normal course of business would not be treated as contribution under foreign contribution regulation act.

A – Yes. As per FCRA rules interest earned on foreign contribution is also traeted as contribution and same need to be updated in form FC-6.

A – No, Society need not be registered as per foreign contribution regulation act. But, it is always practically advisable to have it registered.

A – No, FCRA rules mandates that consultancy income generated by NGO not be considered as contribution as per FCRA 2010.

A – No, political parties cannot apply for a FCRA registration number.

A – There is no set time limit to get FCRA registration number from day of application. However, It usually takes 45-90 days to get FCRA registration number from the day of application.

A – Hard copy of application for FCRA registration number along with documents should reach within 30 days of online application.

A – Fee structure for FCRA registration number is as follows-

A – As per foreign contribution regulation act 2010, an appeal can be made to high court 60 days within rejection. A fresh application can also be filed after 6 months of last application to FCRA authorities.

A – No. As per foreign contribution regulation act 2010, organization need to maintain a single bank account for receiving of contribution. As per FCRA rules, foreign funds cannot be received in different bank accounts.

In this article, we have discussed various FAQs ( frequently asked questions) related to foreign contribution regulation act (FCRA). For further reading on different types of trade licenses required in India, you can visit our website’s other section.