SBI Home Loan EMI Calculator

State Bank of India offers variety of Home Loan products to its customers as well as a new applicant. One can get almost any type of loan with maximum tenures and lower emi compared to other banks. SBI has branches all over India and is also a leader in offering home loan products through digital mediums such as YONO app. SBI Home Loan EMI Calculator is a simple utility which helps a SBI Home loan customer to easily calculates its EMI by entering basic inputs such as loan amount, tenure and rate of Interest.

SBI Regular Home Loan products

State Bank of India (SBI) offers variety of home loan products to individuals as well as corporates entity. One can get virtually loan amount of any amount by visiting a nearest SBI branch or calling a SBI customer care number. SBI requires basic documentations such as KYCs, income proofs to process your home loan application. With increased digitization, one can avail a SBI home loan through a digital process. For complete list of SBI home loan products, you can visit this article.

SBI Home Loan EMI Calculator

Before taking a Home loan from SBI, it is very important to ascertain actual EMI one has to pay against loan taken. EMI stands for equated monthly installments and are charged on a regular interval basis which is usually one month. It is one of the most uncomplicated method to pay off the loan taken.

EMI will always have two components, they are closing principal balance and interest charged on previous closing balance. EMI is a structured payments in which burden of principal gradually reduces and at the end of tenure closing principal will always be zero

SBI Home Loan calculator workings

Let us take a look how a home loan calculator actually works. There are basically two types of Home loan calculators, one is a basic excel and other can be used from online website of a bank.

Home Loan calculator in Microsoft Excel

You can easily calculate your business loan EMI with the help of Microsoft Excel program. For calculation your loan EMI, you would be required to use PMT function in Excel. Working of PMT function is shown below –

| Rate | 1% |

| Nper | 60 |

| PV | 1000000 |

| EMI | ₹ 21,247.04 |

In above example, Excel based Business loan EMI calculator has calculated EMI for a Rs 10 lakhs loan at the rate of 10% per annum for 60 months. Care should be taken to take uniform numbers while inputting formula. For example, if duration chosen is in months then rate of interest should also be inputted in months. To use calculator in Excel, you should be able to use Microsoft Excel and be comfortable in using functions that are provided by Microsoft Excel.

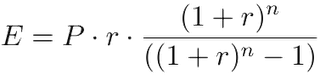

Home Loan EMI calculator foundation

where

E is EMI

P is Principal Loan Amount

r is rate of interest calculated on monthly basis. (i.e., r = Rate of Annual interest/12/100. If rate of interest is 10.5% per annum, then r = 10.5/12/100=0.00875)

n is loan term / tenure / duration in number of months

In most of the business loan products in the market, interest is usually charged on the reducing balance. Due to this reason, interest component of the EMI would gradually increase with time and principal would similarly reduce.

In this article, we have seen working and foundation for an EMI calculator used by industry. If you want to read more about SBI Home loan, you can visit our detailed articles on Home loan here.

SBI Home Loan EMI/Amortization schedule

Sample EMI schedule

| Date | EMI Number | Number of days | Opening Balance | Interest Rate | EMI/ Pre EMI Amount | Interest Due | Principal Due | Closing Balance |

| 28-Jul-21 | ||||||||

| 5-Aug-21 | ||||||||

| 5-Sep-21 | ||||||||

| 5-Oct-21 | ||||||||

| 5-Nov-21 | ||||||||

| 5-Dec-21 | ||||||||

| 5-Jan-22 | ||||||||

| 5-Feb-22 |

SBI Home Loan EMI schedule contain various terms whose meanings are explained below-

- EMI number – EMI number is the serial number for your SBI Home Loan. For example, if your are going to pay your 4th SBI Home Loan EMI, then EMI number would be 4

- Number of days – It is the difference in number of days between next and current EMI

- Opening Balance – Opening balance is the starting figure on which your home loan EMI is calculated. With Each EMI your balance would reduce and you would be required to pay lower interest on your next EMI

- Interest rate or ROI – Interest rate on a Home Loan is the premium that a bank charge for providing a loan.

- EMI – EMI stands for equated monthly installment that a Home Loan customer has to pay each month. EMI would always contain two components i.e. Principal and interest. Principal is the balance amount and interest is the premium that bank charges

Advantages of SBI Home Loan EMI calculator

- You can calculate monthly EMI by changing basic figures such loan rate of interest, tenure and loan amount. This enables one to calculate EMI that is affordable and a loan amount that can fulfill their dream of purchasing a home

- SBI Home Loan EMI calculator helps you save time as well by showing results instantaneously

- You can have an idea of your probable home loan emi before visiting a bank branch

- you can properly plan your finances well in advance before applying for a home loan and will also help you in calculating amount that is required to foreclose your SBI Home Loan